DocuSign Envelope ID: 5BAF3692-7E50-48B0-B4F9-14FDC2929330

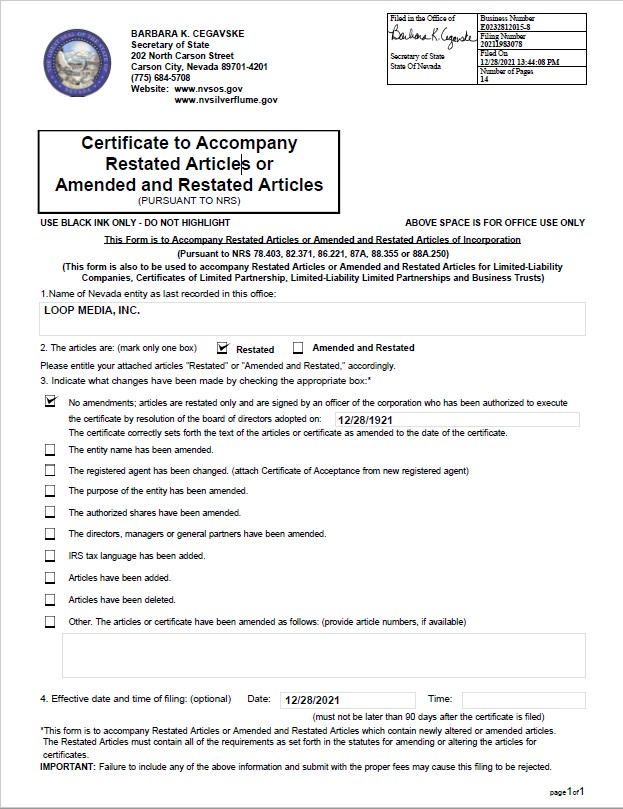

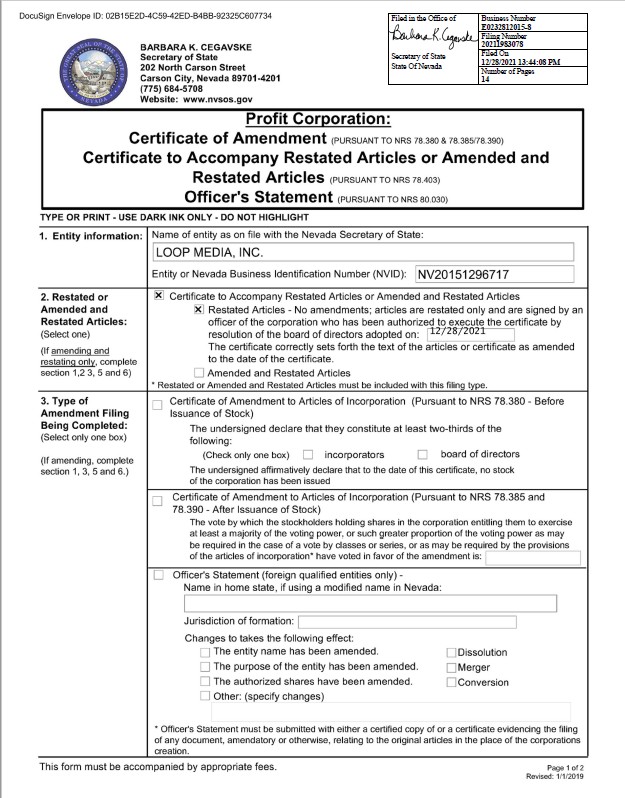

CERTIFICATE OF RESTATED ARTICLES OF INCORPORATION OF

LOOP MEDIA, INC.

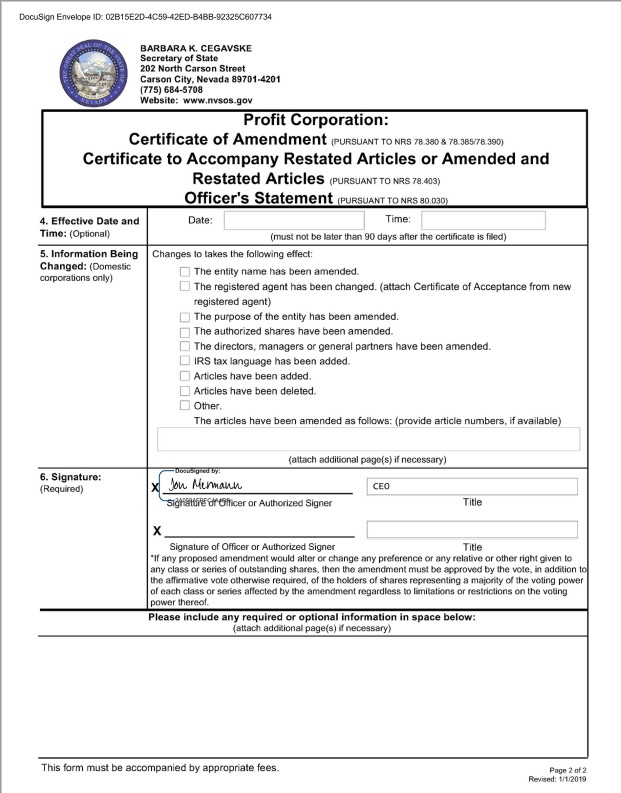

I, the undersigned Secretary of Loop Media, Inc., a Nevada corporation, does hereby certify that:

ARTICLE I NAME

The name of the corporation shall be Loop Media, Inc. (hereinafter, the "Corporation").

ARTICLE II REGISTERED OFFICE

Omitted.

ARTICLE III CAPITAL STOCK

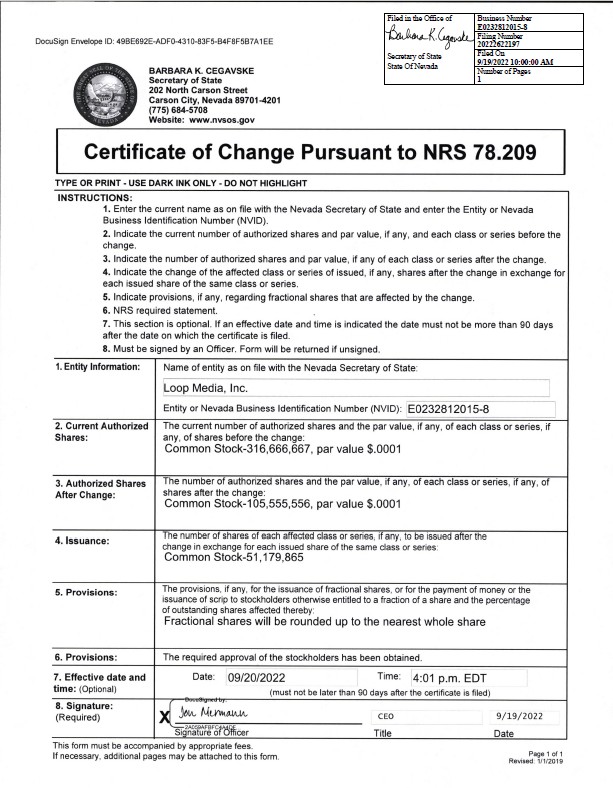

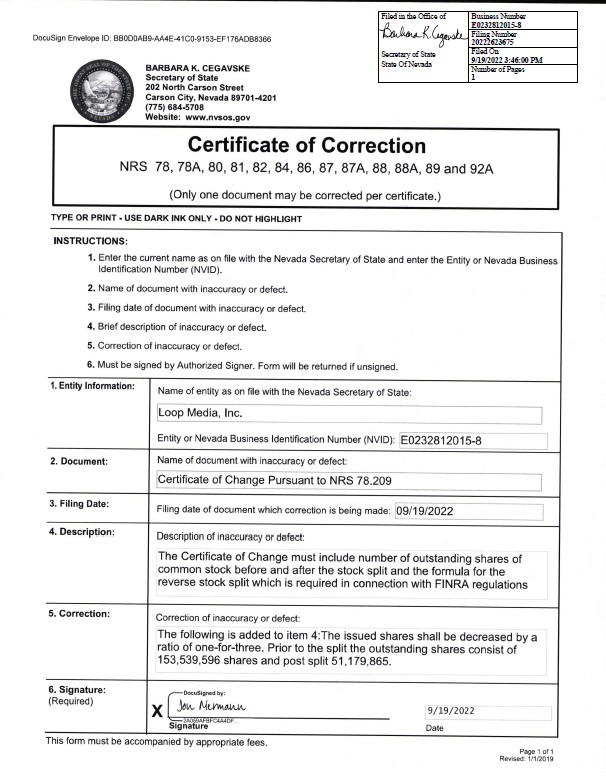

Section 1. Authorized Shares. The aggregate number of shares which the Corporation shall have authority to issue is three hundred thirty three million three hundred thirty three thousand three hundred thirty four (333,333,334) shares, consisting of two classes to be designated, respectively, "Common Stock" and "Preferred Stock," with all of such shares having a par value of $.0001 per share. The total number of shares of Common Stock that the Corporation shall have authority to issue is three hundred sixteen million six hundred sixty six thousand six hundred sixty seven (316,666,667) shares. The total number of shares of Preferred Stock that the Corporation shall have authority to issue is sixteen million six hundred sixty six thousand six hundred sixty seven (16,666,667) shares. The Preferred Stock may be issued in one or more series, each series to be appropriately designated by a distinguishing letter or title, prior to the issuance of any shares thereof. The voting powers, designations, preferences, limitations, restrictions, and relative, participating, optional and other rights, and the qualifications, limitations, or restrictions thereof, of the Preferred Stock shall hereinafter be prescribed by resolution of the board of directors pursuant to Section 3 of this Article III, except for the Series A Convertible Preferred Stock, which is set forth herein.1

Section 2. Common Stock

1 The Series B stock was created by a Certificate of Designation which is incorporated into these Restated Articles.

18996000.2/056437.0001