UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number:

(Exact Name of Registrant as Specified in its Charter)

(State or Other Jurisdiction of Incorporation) | (I.R.S Employer Identification No.) |

(Address of Principal Executive Offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

The aggregate market value of the voting and non-voting common stock held by non-affiliates computed by reference to the price at which the common stock was last sold, or the average bid and asked price of such common stock, as of March 31, 2022, was $

As of December 1, 2022, the registrant had

TABLE OF CONTENTS

3

FORWARD-LOOKING STATEMENTS

Except for historical information, this annual report on Form 10-K (“Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements include, among others, those statements including the words “believes,” “anticipates,” “expects,” “intends,” “estimates,” “plans” and words of similar import. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking statements are based on our current expectations and assumptions regarding our business, potential target businesses, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We caution you, therefore, that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees or assurances of future performance. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Report, could cause our results to differ materially from those expressed in the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include changes in local, regional, national, or global political, economic, business, competitive, market (supply and demand) and regulatory conditions and the following:

| ● | our ability to raise capital when needed and on acceptable terms and conditions; |

| ● | our ability to attract and retain management with experience in digital media including digital video music streaming, and similar emerging technologies; |

| ● | our ability to negotiate, finalize and maintain economically feasible agreements with the major and independent music labels, publishers and performance rights organizations; |

| ● | our expectations regarding market acceptance of our services in general, and our ability to penetrate the digital video music streaming market in particular; |

| ● | the scope, validity and enforceability of our and third-party intellectual property rights; |

| ● | our ability to comply with governmental regulations and changes in legislation or governmental regulations affecting us; |

| ● | the intensity of competition in the markets in which we operate and those that we may seek to enter; |

| ● | the effects of the ongoing pandemic caused by the spread of COVID-19 and our business customers’ ability to service their clients in out of home venues that have limited their public capacity; |

| ● | changes in the political and regulatory environment and in business and fiscal conditions in the United States and overseas; |

| ● | our ability to attract prospective users and to retain existing users; |

| ● | our dependence upon third-party licenses for sound recordings and musical compositions; |

| ● | our lack of control over the providers of our content and the providers’ ability to limit our access to music and other content; |

| ● | our ability to comply with the many complex license agreements to which we are a party; |

| ● | our ability to accurately estimate the amounts payable under our license agreements; |

| ● | the limitations on our ability to reduce operating costs due to the minimum guarantees required under certain of our license agreements; |

4

| ● | our ability to obtain accurate and comprehensive information about music compositions in order to obtain necessary licenses or perform obligations under our existing license agreements; |

| ● | potential breaches of our security systems; |

| ● | assertions by third parties of infringement or other violations by us of their intellectual property rights; |

| ● | competition for users and user listening time; |

| ● | our ability to generate sufficient revenue to be profitable or to generate positive cash flow on a sustained basis; |

| ● | our ability to accurately estimate our user metrics; |

| ● | the manipulation of stream counts and user accounts and unauthorized access to our services; |

| ● | our ability to hire and retain key personnel; |

| ● | our ability to maintain, protect and enhance our brand; |

| ● | risks associated with our international expansion, including difficulties obtaining rights to stream music on favorable terms; |

| ● | risks relating to the acquisition, investment and disposition of companies or technologies; |

| ● | dilution resulting from additional share issuances; |

| ● | tax-related risks; |

| ● | the concentration of voting power among our founders who have and will continue to have substantial control over our business; |

| ● | international, national, or local economic, social or political conditions, and |

| ● | risks associated with accounting estimates, currency fluctuations and foreign exchange controls. |

Other sections of this Report describe additional risk factors that could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time, and it is not possible for our management to predict all risk factors and uncertainties, nor are we able to assess the impact of all of these risk factors on our business or the extent to which any risk factor, or combination of risk factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks and others described under the section “Risk Factors” below are not exhaustive.

Given these uncertainties, readers of this Report are cautioned not to place undue reliance on such forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

5

PART I

ITEM 1. BUSINESS.

Overview

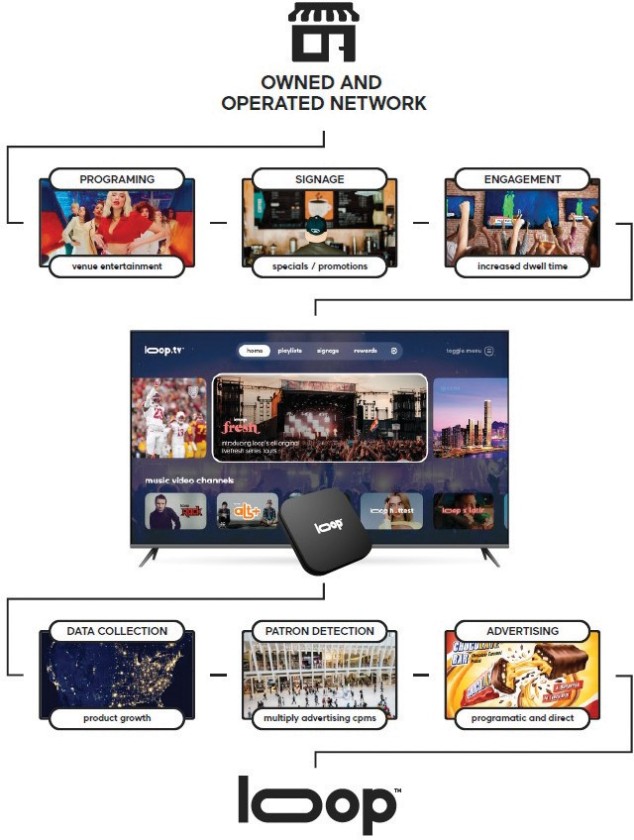

Loop Media, Inc. (collectively, “Loop Media,” the “Company,” “we,” “us” or “our”) is a multichannel digital video platform media company that uses marketing technology, or “MarTech,” to generate our revenue and offer our services. Our technology and vast library of videos and licensed content enable us to curate and distribute short-form videos to out-of-home (“OOH”) dining, hospitality, retail, convenience stores and other locations and venues to enable them to inform, entertain and engage their customers. Our technology provides third-party advertisers with a targeted marketing and promotional tool for their products and services and, in certain instances, allows us to measure the number of potential viewers of such advertising and promotional materials. We also allow our OOH clients to access our service without advertisements by paying a monthly subscription fee.

We offer hand-curated music video content licensed from major and independent record labels, including Universal Music Group (“Universal”), Sony Music Entertainment (“Sony”), and Warner Music Group (“Warner” and collectively with Universal and Sony, the “Music Labels”), as well as non-music video content, which is predominantly licensed or acquired from third parties, including action sports clips, drone and atmospheric footage, trivia, news headlines, lifestyle channels and kid-friendly videos, as well as movie, television and video game trailers, amongst other content. We distribute our content and advertising inventory to digital screens located in OOH locations primarily through (i) our owned and operated platform (the “O&O Platform”) of Loop Media-designed “small-box” streaming Android media players (“Loop Players”) and legacy ScreenPlay (defined below) computers and (ii) through screens on digital platforms owned and operated by third parties (each a “Partner Platform” and collectively, the “Partner Platforms,” and together with the O&O Platform, the “Loop Platform”). As of September 30, 2022, we had 18,240 quarterly active units (“QAUs”) operating on our O&O Platform. See “Management’s Discussion and Analysis of Financial Condition and Results of Operation — Key Performance Indicators.” We launched our Partner Platforms business beginning in May 2022 with one partner on approximately 17,000 of the partner’s screens, and are in the process of finalizing an additional approximately 13,500 screens in a second Partner Platform for a total of approximately 30,500 screens across our Partner Platforms in the near term. We expect to begin earning revenue on these additional screens in our second fiscal quarter ending March 31, 2023. Our legacy subscription-based business complements these newer businesses.

We moved to an advertising-based model and ramped up distribution of Loop Players for our O&O Platform starting in early 2021. We recently disabled our consumer mobile app, as we de-emphasize our direct to consumers (“D2C”) business to focus resources on our OOH business and services.

MarTech

MarTech, the intersection of marketing and technology, leverages data and analytics to expand our points of distribution and advertising revenue.

Distribution

Owned & Operated Platform (O&O). We moved to an advertising-based model and ramped up distribution of Loop Players for our O&O Platform starting in early 2021. Our customer acquisition strategy for our O&O Platform is focused on marketing and distributing our Loop Player to businesses through social media and other online mediums, our internal enterprise sales team and our affiliate marketing programs. We seek to optimize our social media and online customer acquisition and the distribution of our Loop Players by analyzing various data, including our return on marketing investments. When analyzing the success of our marketing investments, we examine the number of sales leads obtained from online platforms and the conversion of leads into high quality clients. We regularly analyze the engagement with, and success of, our creative advertising content and modify our messaging to improve customer acquisition for our O&O Platform. Our enterprise sales team targets multi-location retail businesses or franchised chains in key markets and

6

industries in the United States that are attractive to OOH advertisers. Our affiliate marketing program incentivizes third parties that have pre-existing connections with retail venues or otherwise qualify for our program to market and distribute our Loop Players and help ensure that they remain active and are servicing advertisements. As of September 30, 2022, we had 18,240 QAUs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operation — Key Performance Indicators.”

Partner Platforms. Through our Partner Platforms business, we offer curated content and programmatic advertising sales expertise and technology to third parties looking to optimize advertising revenue on their existing distribution platforms. We work directly with programmatic advertising demand companies to sell advertising inventory on the Partner Platforms. We collect revenues from the demand partners and pass along a percentage of such revenues to our Partner Platform client. We launched our Partner Platform business beginning in early May 2022 with one partner on approximately 5,000 of the partner’s screens, and we rolled out to the remaining 12,000 screens in that network as of mid-May 2022. We are in the process of finalizing an additional approximately 13,500 screens in a second Partner Platform, for a total of approximately 30,500 screens across our Partner Platform in the near term. We are looking to continue to expand our Partner Platforms business over time. Our cost of revenue for advertising sales on our Partner Platforms business is higher than our cost of revenue for advertising sales on our O&O Platform due to our significant revenue share with our Partner Platform clients, even though we are able to share typical transaction costs associated with the related programmatic advertising sales and server costs with such clients. Our ability to monetize the screens in our Partner Platforms business will differ from Partner Platform to Partner Platform, as certain screens will be more desirable than others for advertisers, depending on the type of venues or locations in which the screens are located, the concentration of screens, the expected or actual number of consumers, dwell time of those consumers and other factors. As a result, the

7

average revenue per screen for individual partners and individual screens in our Partner Platforms business is expected to be more varied than our ARPU for our O&O Platform business.

Advertising Revenue

Our revenue is primarily driven by programmatic advertising, an automated measurement process that manages the sales of our advertising inventory. Today, most digital advertising is programmatic advertising, with digital OOH advertising comprising a small portion of the overall market. While we look to establish direct advertising and sponsorship opportunities with advertisers, almost all of our current advertising revenue is purposely secured through programmatic advertising. Our yield optimization strategies look to leverage data analytic and other techniques to maximize the value of our digital advertising inventory. We intend to optimize the combination of our ad impressions, cost per impression and the percentage of our ad inventory filled by advertisers, while balancing our O&O Platform’s and our Partner Platform’s clients’ experience by limiting the number of ads delivered during any given period. Our Loop Player is designed to allow us to multiply OOH revenue in certain locations in the event that the advertising industry recognizes, and is willing to pay for, multiple advertising impressions for a single Loop Player for venues with multiple persons who may be in a position to view the relevant advertisement, as outlined below. We don’t currently benefit materially from this “multiplier effect,” as not all demand partners and advertisers recognize this approach for their advertising spend.

8

Loop Player

The Loop Player is at the heart of our O&O Platform revenue model and its technology enables us to communicate and interact with OOH locations, advertisers, and OOH customers:

| ● | OOH Locations. The Loop Player allows OOH clients to program their in-store monitors and audio systems to schedule playlists depending on the time of day, promote their products or services through digital signage and deliver company-wide messages to staff in back-office locations. Business owners can filter content based on ratings or explicit language and can control the genres of videos in their programs. The Loop Player caches and encrypts our content, thereby supplying uninterrupted play for up to 12 hours in the event of an internet disruption. |

| ● | Advertising and Content Partners. Our Loop Player works with our technology, software and servers to determine the number of ad impressions available for programmatic advertising, which can be filled in real-time, seconds before ads are played. Our Loop Player delivers content and advertising to venues and our technology allows us to record and report video content played (for reporting to content providers) and advertising content played (for reporting to our advertising demand partners and advertisers). In particular, our technology allows us |

9

| to track when, where and how long content is played, and, in certain instances, measure approximately how many consumers were in position to view the content or advertisement. The Loop Player’s WiFi and Bluetooth capabilities allow us to determine the number of potential viewers at a given location, which can, in certain instances, provide us with a revenue multiplier, as we expect to be able to increase advertising revenue at high-volume locations in the event that the advertising industry recognizes, and is willing to pay for, multiple advertising impressions for a single Loop Player for venues with multiple persons who may be in a position to view the relevant advertisement. This “multiplier effect” is possible due to the Loop Player’s ability to detect, using Bluetooth and WiFi technology, the number of consumer mobile devices within reach of a Loop Player in an OOH location which provides advertisers with a proxy for the number of potential viewers of a particular ad at any given time. The digital advertising market for out of home locations is still developing and the multiplier effect is not yet available in all locations and with all advertising demand partners or advertisers and there is no assurance that it will become more widely available in the short term or at all. We don’t currently benefit materially from this “multiplier effect,” as not all demand partners and advertisers recognize this approach for their advertising spend. |

| ● | OOH Customers. We are seeking to develop further the interactivity between the Loop Player and the customers in OOH locations. This may take different forms, such as offering a simple thumbs up or thumbs down function, displaying the number of customer votes for a given piece of content, answering trivia questions, downloading of OOH venue menus and other helpful consumer information from the screens and other functions. This will require development of a mobile application in the future. |

| ● | Loop Player. We are able to consistently monitor the preferences of our OOH customers and venue operators through our Loop Player. Our Loop Player allows us to collect specific information and data on content played, views, location, and location type, enabling us to effectively measure demand. These capabilities allow us to make informed decisions around which type of content to acquire or develop, as well as identify new market opportunities. |

10

The Loop Platform

The following table sets forth the Loop Platform customer targets, delivery method, preferred revenue model and the associated content for our services:

PLATFORM | CUSTOMER | PRIMARY DELIVERY METHOD | PREFERRED REVENUE MODEL | CONTENT |

O&O Platform | OOH Location | Loop Player | Ad-supported service | ● All forms of content, including music video and other content ● Curated playlists and channels |

Partner Platform | Third-party with its own distribution platform | Third-party screens | Ad-supported service | ● Selected Loop Media content ● Third-party Partner content |

During the pandemic, as many business owners were forced to shut down or reduce capacity, we increased our focus on providing services direct to consumers (“D2C”) in their homes on connected TVs (“CTVs”). As demand for content from over-the-top (“OTT”) businesses and free-ad-supported television (“FAST”) platforms increased, we sought to fill that demand with certain of our hand-curated video channels. As the growth trajectory of OTT D2C business slowed and our OOH business gained traction as we moved to an ad-based business model utilizing the Loop Player, we reduced our exposure to a D2C business model and increased our focus on building out our OOH business, a more profitable and commercially viable area of our market. As a result, we have de-emphasized our consumer D2C business, including recently disabling our consumer mobile app, to focus resources on our OOH free ad-supported business model and services. We may look to develop our consumer mobile app to complement and supplement our OOH business in the future by enabling OOH venue operators and their customers to interact with the OOH content delivered in their venues by using a mobile device.

O&O Platform and OOH Locations

The foundation of our business model is built around the OOH experience, with a focus on distributing licensed music videos and other content to public-facing businesses and venues. Our OOH offering has supported hospitality and retail businesses for over 20 years, originally through ScreenPlay, Inc. (“ScreenPlay”), which we fully acquired in 2019. Since the acquisition of ScreenPlay, we have primarily focused on acquiring OOH clients throughout the United States.

Most OOH locations in the United States deliver visual content to their customers by the use of cable TV boxes and computer-based audio video equipment, which requires significant investment and cost to the venue operator. Capital investment in equipment has historically been a barrier for many businesses to provide visual entertainment to their customers. Unlike consumers in their homes, who have been more willing in recent years to invest in CTVs and streaming services, businesses generally have been slower in adopting lower cost streaming options.

To gain greater access to, and expand our business with, OOH venue operators, we developed our proprietary Loop Player. The Loop Player is easy to set up and allows content to be streamed on multiple television sets. We believe our Loop Player and free, ad-supported service has significantly reduced the cost of specialty equipment and visual entertainment for venue operators.

We began rolling out the Loop Player in the fourth calendar quarter of 2020. We believe the COVID-19 pandemic, which caused many businesses to shut down or reduce capacity, acted to accelerate business owners’ demand for CTVs and streaming services to reduce their costs. For this reason, we believe the introduction of our Loop Player, coupled with

11

our switch to a free ad-supported business model, has contributed to the growth in calendar 2021 and 2022 of OOH business clients using our services. In 2021, our client base began to expand beyond our typical hospitality-based clients to smaller venues, franchisees and venues that service non-hospitality industries, like pet stores, doctors’ offices and other non-traditional venues. This trend continued into 2022.

We expect revenue from our DOOH ad-supported service to increase to a greater extent than our revenue from our other services. This is partly due to our ongoing efforts to add new OOH locations to our distribution network, which increases the number of Loop Players in the market and, in turn, the number of ad impressions available for advertisers to fill with paid advertisements and sponsorships. Our new Partner Platforms business has expanded and is expected to further expand our OOH ad-supported business.

Partner Platform

Our Partner Platforms business targets third parties with existing distribution platforms that have a significant number of screens in desirable OOH locations and venues. None of our Partner Platform clients have requested the installation of Loop Players to deliver our streaming content and advertisements, but some may do so in the future. Our revenue model for the Partner Platforms business is all ad-supported and the content delivered may be content sourced by our Partner Platform clients or by Loop.

Our Competitive Strengths

Diversified Content Library, including Music Videos

We believe our music video library is one of the largest in the world and gives us an advantage over many of our competitors. Our music video library contains videos dating back to the 1950s, appealing to generations of music-lovers, with the newest videos directly obtained from the Music Labels. Older music video libraries are more difficult to obtain, as there is generally no central database from which to acquire such videos. Additionally, the individual music labels who have rights over portions of such videos do not easily and readily provide them to those seeking to acquire them. We have the ability to monetize our music video content through our license agreements with the individual Music Labels. We have also developed a large non-music video library of content, primarily through revenue share license agreements, which generally do not require any upfront payments. We also have purchased and will seek to continue to purchase content for a one-time fee, which allows us to use the content over a period of time without limit and without any revenue share arrangements to the relevant content provider. Our non-music video library consists of action sports clips, drone and atmospheric footage, trivia, news headlines, lifestyle channels and kid-friendly videos, as well as movie, television and video game trailers, amongst other content.

Efficient Content Curation

We believe we are able to produce engaging video content by curating our own and third party-content at relatively low production costs. We do not currently produce a meaningful amount of original video content, which can be expensive and time consuming. In contrast to many streaming platforms, we curate existing content from our video library and content licensed and purchased from third parties. The curation of our video content from our owned and leased libraries eliminates the costly and lengthy production process associated with creating original video content. We believe this allows us to regularly innovate, update, and enhance our content offerings in a cost-effective and timely manner.

National Distribution and Reach

We distribute our services across thousands of OOH locations, audio and video streaming platforms, and mobile and connected TV applications. We had 18,240 QAUs operating on our O&O Platform across North America for the quarter ended September 30, 2022, and our non-music channels are currently accessible in over 400,000 hotel rooms. Our internal salespeople engage in direct marketing for our OOH business across all regions of the United States. We launched our Partner Platforms business beginning in May 2022 with one partner on approximately 17,000 of the partner’s screens and are in the process of finalizing an additional approximately 13,500 screens in a second Partner Platform for a total of

12

approximately 30,500 screens in our Partner Platforms in the near term. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Key Performance Indicators” for a description of QAUs.

Technology Based Business Model

All of our key software and the design of our Loop Player has been developed in-house by our technology team. We have built our services and platform with a view to the future, focusing on where we believe the digital OOH market is and will be for the foreseeable future. The Loop Player is ideal for OOH location operators looking to “cut the cord” from their old business models. This allows our OOH clients to save costs and provides them with a greater ability to customize and schedule content to fit their venues. We use digital marketing technology, or “MarTech,” to generate revenue, market our services and fuel our business. Our experience and technological capabilities in digital marketing has allowed us to expand our business into our Partner Platforms business, where we offer programmatic advertising sales expertise and technology to third parties looking to optimize advertising revenue on their existing distribution platforms and screens. Additionally, we believe we can attract key employees from across geographies as we operate almost entirely remotely in support of our culture of technology and efficiency. Our use of technology in most aspects of our business, including marketing, distribution, content curation, sales, customer service and other areas, allows us to leverage our existing employees as we continue to scale up our business.

Established Foundation Supported by Industry Tailwinds

Our technology stack, ad-supported revenue model and vast content library are the backbone of our business. We believe this established foundation places us in a better position than many peers to benefit from any industry tailwinds in the digital OOH advertising market. Because our foundation has been built with a view to where we believe the OOH content delivery and digital marketing trends are headed, we believe we are better positioned than many of our competitors who might have to re-work their existing technology and revenue models to better align with these trends. We believe our programmatic advertising expertise in the OOH market will support our revenue infrastructure for the foreseeable future. See “Business — Digital-Out-of-Home-Industry.”

Passionate and Experienced Management Team

Our seasoned management team is founder-led and has more than 100 years of combined media and technology experience. Our executive team has previous experience at some of the most well recognized entertainment companies in the world, including Walt Disney, Universal Music, MTV, VH1, CBS, Sony, Viacom, Time Warner, Electronic Arts, among others.

Our Growth Strategies

Our growth strategies are focused on monetizing and growing our content library and are guided by the following six pillars:

Increase Marketing of Loop Player for our O&O Platform. We have found online digital advertising to be a successful customer acquisition strategy and believe there is a direct correlation between digital marketing spend and business demand for the Loop Player in our O&O Platform. In addition to digital advertising viewed by individual businesses, we also intend to leverage our internal sales team to increase our direct marketing efforts to promote our Loop Player and services to large, national or regional, franchisee or corporate owned businesses. We have also established an affiliate program whereby we incentivize third parties that have connections with OOH venues or otherwise qualify for our program to market and distribute our Loop Players and help ensure that they remain active and are servicing advertisements.

Expand our Partner Platforms Business. We believe we are at the forefront of digital programmatic advertising distribution and monetization in the DOOH industry. This has resulted in the expansion of our business to include our Partner Platforms business, which allows us to offer our advertising sales services and curated content to third parties looking to distribute our content and advertising to screens on digital networks

13

owned and operated by such third parties. We launched our Partner Platforms business beginning in May 2022 with one partner on approximately 17,000 of the partner’s screens and are in the process of finalizing an additional approximately 13,500 screens in a second Partner Platform, for a total of approximately 30,500 screens across our Partner Platforms in the near term. We are looking to expand our Partner Platforms business over time.

Diversify Customer Base. We believe the introduction of our Loop Player and shift towards an ad- supported service model has contributed to the growth of our OOH customer base and related revenues. Our customer base has expanded beyond our typical hospitality, food and beverage and gym clients, as we have experienced an increase in business engagement from smaller venues, franchisees, and businesses that service other industries. This expansion has given us greater insight into the viewing habits of a diverse customer base and the demand for some of our non-music video content, thereby enabling us to develop and curate content that continues to respond to consumer demand.

Expand our Non-Music Video Content. Our music video library is the foundation of our business but, in certain instances, OOH locations are looking for a broader or more targeted content offering than pure music videos. Since the acquisition of ScreenPlay’s music video library in 2019, we have sought to expand our non-music video content through licensing, purchases and our own development, which includes content in entertainment, lifestyle, and information channels. We introduced a Trivia channel on our service in July 2022, which we developed internally, and which is not subject to a revenue share agreement with any third parties for the use of the content. We will look to develop additional channels by curating content with no or limited licensing fees to help grow our business and, where possible, enhance our operating margins.

Optimize Advertising Sales and Exploring Advertising Sponsorships. We aim to optimize our advertising sales by using technology and short-term, third-party consultants to collect data and employ analytics. Similarly, we will seek to continue to optimize our programmatic revenue through MarTech data and analytics. In addition to these efforts in mid-2022, we expanded our advertising sales team to focus on advertising sales directly to companies that seek to advertise on our platform and to companies that are interested in providing sponsorship of our content if any. Through such arrangements, to the extent we are able to secure them, we may receive payments from a company in return for allowing such company to be associated with one of our channels, playlists, other content or company events.

International Expansion. We plan to explore international expansion in the years ahead, as we believe the provision of video content in the non-U.S. OOH markets is underserved. In 2021, we began to explore opportunities overseas and acquired EON Media Group Pte. Ltd. (“EON Media”), which produces a weekly syndicated music radio program targeted across Asia. Over time, we plan to be opportunistic in exploring ways to potentially expand in Asia, certain countries in South America, Canada and Europe.

Our Content

Content Acquisition

Music Videos. Although we own copies of the music videos that we deliver to our clients, we must secure the rights to stream the video, the sound recordings, and the musical compositions embodied therein (i.e., the musical notes and the lyrics). To do so, we enter into license agreements to obtain licenses from rights holders such as record labels, music publishers, performance rights organizations, collecting societies, and other copyright owners or their agents, and pay royalties to such parties or their agents.

We have longstanding and recently renewed and updated limited, non-exclusive licenses to digitally distribute certain music videos and related materials owned or controlled by two of the three Music Labels to our OOH clients in the United States and are in the process of renewing a similar license with the third Music Label. In 2020, we entered into separate license agreements with the Music Labels, pursuant to which we were also provided limited, non-exclusive licenses to digitally distribute certain music video recordings and related materials owned or controlled by the Music Labels in connection with our D2C business. We have since let those licenses expire, as we have decided to de-emphasize

14

our consumer D2C business to focus resources on our OOH business and services. Further to this focus, we have shut down our consumer mobile app and are seeking to transition our content offering to consumer FAST platforms away from music video content to other content. There is no assurance that FAST platforms will want to partner with us for non-music video channels, in which case we may no longer operate our consumer OTT business, which currently represents a small portion of our total revenue.

Trailers. Our film, game and TV trailer library is one of our largest video libraries. Similarly, to our music video library, it includes a back catalog of old videos, dating back to the early 1900s. More recent trailers are secured from the relevant production companies, at no cost to us, and are added to our growing library. Our back catalog of older trailers was obtained with the acquisition of ScreenPlay.

Other. In addition to music videos and movie trailers, we have obtained other video content for curation and distribution to our clients. This content includes action sports clips, drone and atmospheric footage, trivia, news headlines, lifestyle channels and kid-friendly videos, as well as movie, television and video game trailers, amongst other content.

We continue to explore opportunities to secure other forms of video content to add to our growing content library.

Content Curation

In November 2020, we created a new business division at Loop, called Loop Media Studios (“Loop Studios”), to lead the acquisition, curation, production, and branding of our video content.

Loop Studios works to curate content to create a compelling user experience by, among other things, curating Playlists by genre, mood, or time periods. Additionally, Loop Studios creates streaming channels, delivered under our “watch live tv” product feature on our Loop Player. We currently have approximately 169 music video channels for OOH clients and 50 non-music video channels for OOH clients.

Through Loop Studios we seek to produce our own content “in-house” that can be packaged separately or as part of our third-party content offerings, and we plan to deliver this content through our existing and future channels. For the foreseeable future this in-house content will largely consist of acquiring hours of third-party content, in return for a one-time fee for the use of the content for a period of years and curating that content into Loop branded channels.

Content Distribution

We aim to make our content available primarily in OOH venues and locations. To achieve this objective, we currently leverage our existing content across thousands of OOH locations. We had 18,240 QAUs operating on our O&O Platform across North America for the quarter ended September 30, 2022, and our non-music channels are currently accessible in over 400,000 hotel rooms. We have recently hired salespeople to engage in direct marketing for our OOH business across various regions, including the East Coast, West Coast and South. We launched our Partner Platforms business beginning in May 2022 with one partner on approximately 17,000 of the partner’s screens and are in the process of finalizing an additional approximately 13,500 screens in a second Partner Platform for a total of approximately 30,500 screens in the near term.

License Agreements

In order to stream video content to our users, we generally secure intellectual property rights to such content by obtaining licenses from, and paying royalties or other consideration to, rights holders or their agents. Below is a summary of certain provisions relating to our license agreements for music videos, the musical compositions embodied therein, as well as other non-music video content.

15

Music Video and A/V Recordings License Agreements with Major and Independent Record Labels

We enter into license agreements to obtain rights to stream music videos to our OOH clients, including from the Music Labels. These agreements require us to pay royalties and make minimum guaranteed advanced payments, and they include marketing commitments, advertising inventory and financial and data reporting obligations. Rights to A/V recordings granted pursuant to these agreements is expected to account for the vast majority of our music video use for the foreseeable future. Generally, these license agreements have a short duration and are not automatically renewable. The license agreements also allow for the licensor to terminate the agreement in certain circumstances, including, for example, our failure to timely pay sums due within a certain period, our breach of material terms and certain situations involving a “change of control” of Loop. These agreements provide licensors the right to audit us for compliance with the terms of these agreements. Further, they contain “most favored nations” provisions, which require that certain material contract terms be at least as favorable as the terms we have agreed to with any other similarly situated licensor. Our current license agreements with the Music Labels for our OOH business were recently renewed. The recently entered license agreements are expected to slightly increase our license costs associated with the relevant license rights. A significant portion of our OOH business relies upon these licenses, and if we fail to maintain and continually renew these licenses our business, operating results, and financial condition could be materially harmed.

Musical Composition License Agreements

Our business model requires that we also obtain two additional types of licenses with respect to musical compositions: mechanical and public performance rights. Mechanical licenses are required to distribute recordings written by someone other than the person or entity conducting the distribution. Such licenses ensure that the music publisher, and ultimately the songwriter, receive compensation for the use of their work. A public performance license is an agreement between a music user and the owner of a copyrighted composition (song) that grants permission to play the song in public, online, or on radio. We have obtained direct licenses for mechanical rights with the three largest publishers, which are respective affiliates of each of the Music Labels for our OOH business. As a general matter, once music licenses are obtained from the Music Labels, their affiliate publishing companies enter into agreements with respect to the mechanical licenses. If our business does not perform as expected or if the rates are modified to be higher than the proposed rates, our music video content acquisition costs could increase, which could negatively impact our business, operating results, and financial condition, hinder our ability to provide interactive features in our services, or cause one or more of our services not to be economically viable due to an increase in content acquisition costs.

In the United States, public performance rights are generally obtained through PROs, which negotiate blanket licenses with copyright users for the public performance of compositions in their repertory, collect royalties under such licenses and distribute those royalties to music publishers and songwriters. We have obtained public performance licenses from, and pay license fees to, the PROs in the United States: ASCAP, BMI, the SESAC, LLC and Global Music Rights, LLC. These agreements impose music usage reporting obligations on Loop and grant audit rights in favor of the PROs. In addition, these agreements typically have one-to-two-year terms, and some have continuous renewal provisions, with either party able to terminate for convenience within 30 to 60 days prior to the end of the applicable term (or commencement of the subsequent term) and are limited to the territory of the United States and its territories and possessions.

License Agreements with Non-Music Video Content

With respect to non-music content, we obtain distribution rights directly from rights holders. We then negotiate licenses directly with individuals or entities in return for providing such licensors with either a fixed fee or a share of revenue derived from the licensed content distributed through our services. We are dependent on those who provide the content that appears on our services complying with the terms and conditions of our license agreements. However, we cannot guarantee that rights holders or content providers will comply with their obligations, and such failure to do so may materially impact our business, operating results, and financial condition.

16

License Agreement Extensions, Renewals, and Expansions

From time to time, our various license agreements described above expire while we negotiate their renewals. In accordance with industry custom and practice, we may enter into brief (for example, month-, week-, or even days-long) extensions of those agreements or provisional licenses and/or continue to operate on an at will basis as if the license agreement had been extended. It is also possible that such agreements will never be renewed at all, which could be material to our business, financial condition and results of operations. License agreements are generally restrictive as to how the licensed content is accessed, displayed and manipulated, as licensors seek to protect the use of their content. We may from time to time seek expansion of our licenses to provide us with greater functionality of our services as it relates to the relevant content. The inability to expand our licenses, or the lack of renewal, or termination, of one or more of our license agreements, or the renewal of a license agreement on less favorable terms, could have a material adverse effect on our business, financial condition, and results of operations. If any of the above were to occur, our ability to provide any particular content that our clients favor or are seeking would be limited, which would result in those clients going elsewhere. See “Risk Factors — Risks Related to Our Business — We depend upon third-party licenses for substantially all of the content we stream and an adverse change to, loss of, or claim that we do not hold any necessary licenses may materially adversely affect our business, operating results, and financial condition.”

Competition

Our competitive market is made up of a variety of small to large companies, depending upon the area that we are competing in.

In the OOH market, we compete with small companies in a fragmented marketplace. Our direct competitors include Atmosphere, UPshow and Rockbot. We believe that the major competitive factors in the OOH marketplace are price, technology, quality music video content and other entertainment content.

In the OTT market, we have historically competed with a significant number of large and small companies to secure our service on OTT devices and, once on the service, we competed for individual viewers of our product. We believe that the major competitive factors in the OTT marketplace are quality content and revenue share splits.

Marketing and Sales

Our sales and marketing efforts are primarily focused on reaching our OOH clients. Historically, when we operated our ScreenCast system developed by Screenplay, our sales cycle from first contact with a potential customer to adoption of our services was relatively long and met with varying degrees of success, as the A/V equipment required to run our services was often considered expensive by many of the venues looking to acquire it. Our sales and marketing efforts historically were almost entirely dependent on direct marketing by our internal sales representatives, including multiple contacts, onsite demonstrations of our services and potentially on-site installation and technical support, when needed. The introduction of our Loop Player for OOH locations has enabled us to adopt a digital marketing strategy, in addition to our direct marketing.

Following the introduction of our proprietary Loop Player, our sales and marketing strategy for OOH clients has consisted of bottom-up and top-down approaches. Our bottom-up approach markets our Loop Player and our OOH business through digital marketing to potential business clients for use at their individual venues. The marketing reaches these businesses through the Internet, mobile devices, social media, search engines and other digital channels. Our digital marketing campaign targets businesses in certain industries that are more likely to use our services and become a customer, as determined by our past experience and by analyzing and identifying leads sourced from our online marketing channels. We supplement these digital marketing efforts with our affiliate program, in which third parties market our Loop Players to OOH locations in return for an affiliate fee. We are able to mail a physical Loop Player to individual businesses that sign up for our services online upon verification of the business venue. We then utilize our team of customer service personnel, digital prompts, including text messages, and promotional rewards to ensure activation of the Loop Player after receipt by the potential customer. For our paid subscription services, a sales representative will call the potential business customer to better communicate the various subscription services pricing and availability.

17

Our top-down approach for OOH marketing and sales relies on our internal sales team targeting large, national or regional, franchisee or corporate-owned, businesses, to promote our Loop Player and services in multiple venues controlled by them. We often will obtain a lead for these businesses from individual venues in such business’ network of venue operators and owners. The top-down approach has a longer sales cycle but should result in a greater reach and distribution of our Loop Player and services, since we are able to enter multiple venues at a single time, once adopted.

We have scaled back our sales and marketing efforts in our D2C consumer business significantly as we de-emphasize our D2C consumer business. Historically, these efforts have relied on our internal direct marketing and sales team to approach various Smart TV and FAST platform operators, distributors, and manufacturers.

Seasonality

We have seen seasonality in our revenue and business related to advertising sales and the distribution of our Loop Player. This seasonality may not be reflected in our results of operations as we experienced overall growth in revenue in recent quarters, which may obscure underlying seasonal trends. The underlying seasonality, nonetheless, may act to slow our revenue growth in any given period.

Our revenues are extremely reliant on digital advertising sales. Revenue associated with such sales is dependent on our ability to fill our ad inventory for our OOH locations using our ad-supported services and the price, or cost-per-thousand ad impressions (“CPMs”), at which such inventory can be sold. Advertisers usually manage their budgets on a quarterly basis, which results in lower CPMs at the beginning of a quarter and an increase at the end of a quarter. Similarly, for advertisers that manage budgets monthly, there is often lower CPMs at the beginning of a month. The first quarter of the calendar year (our second fiscal quarter) is traditionally the least profitable quarter in terms of revenue generation for ad publishers (such as us), as advertisers are holding and planning their budgets for the year and consumers tend to spend less after the winter holiday season. This results in fewer ad demands and lower CPMs. The second quarter of the calendar year, from April to June (our third fiscal quarter), typically experiences increased ad demand and higher CPMs over the first quarter of the calendar year (our second fiscal quarter), as advertisers start to spend their budgets in greater amounts. The third quarter of the calendar year, from July to September (our fourth fiscal quarter), typically sees a slight increase in CPMs and ad demands compared to the second quarter of the calendar year (our third fiscal quarter), even though consumers spend more time outdoors and less time online in the summer months. The fourth quarter of the calendar year, from October to December (our first fiscal quarter), is typically the most profitable quarter for publishers, as companies want their brands and products to be seen in the run up to the holiday season. This generally results in publishers receiving the highest CPMs and the greatest ad demand for their ad impressions during the fourth quarter of the calendar year (our first fiscal quarter). As a result of these market trends for digital advertising, we generally expect to receive higher CPMs and greater ad fill rates during the fourth quarter of a calendar year (our first fiscal quarter) and lower CPMs and reduced ad fill rates during the first quarter of a calendar year (our second fiscal quarter). We seek to offset the reduction in CPMs and ad fill rates with increased Loop Player distribution and ad impressions across our ad- supported services.

Our customer acquisition cost is largely influenced by the cost of our digital marketing, as a significant portion of our Loop Player distribution is reliant on OOH locations responding to our on-line advertisements. We see a direct correlation between the number of digital advertisements we run and the growth in our on- line customer acquisitions. The cost of the digital ads we run fluctuates from quarter to quarter and month to month and is generally based upon the overall market CPMs and the market demand for digital ad impressions. We continuously monitor CPMs and ad demand with a view to balancing our desire to grow our distribution of Loop Players and the cost of acquisition associated with such growth. As a result, we generally look to reduce our digital marketing spend during times of peak demand and highest cost of digital advertising and look to increase our digital marketing spend during times of lower demand and lower cost. We also moderate our digital marketing spend during periods where our OOH clients may be less likely to sign up for our ad-supported OOH services (e.g., the winter holiday periods). A reduction in digital advertising spend by us during a particular period could slow our Loop Player distribution growth figures for that period, even as we continue to grow our overall distribution of Loop Players. We look to offset any slowed growth by, among other things, using data and analytics to make our individual digital ads more effective at acquiring clients.

18

Our Technology and Intellectual Property

We have developed our own software, computer code and related items to provide our service and do not materially rely on any third-party providers. Our Loop Player is a proprietary device, designed by us in-house. The Loop Player is manufactured in Shenzhen, China, by an authorized third-party original equipment manufacturer (“OEM” manufacturer). We do rely on third-party partners to provide services such as payment systems and server hosting platforms, all of which are industry-standard support systems, none of which have proprietary information and for which alternative providers can easily be found.

Our intellectual property rights are important to our business. We rely on a combination of patent, copyright, trademark, service mark, trade secret, and other rights in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our proprietary technology, processes and other intellectual property. We protect our intellectual property rights in a number of ways including entering into confidentiality and other written agreements with our employees, clients, consultants and partners in an attempt to control access to and distribution of our documentation and other proprietary technology and other information. Despite our efforts to protect our proprietary rights, third parties may, in an unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute our intellectual property rights or technology.

U.S. patent filings are intended to provide the holder with a right to exclude others from making, using, selling or importing in the United States the inventions covered by the claims of granted patents. Our patents, including our pending patents, if granted, may be contested, circumvented, or invalidated. Moreover, the rights that may be granted in those issued and pending patents may not provide us with proprietary protection or competitive advantages, and we may not be able to prevent third parties from infringing on those patents. Therefore, the exact benefits of our issued patents and our pending patents, if issued, and the other steps that we have taken to protect our intellectual property cannot be predicted with certainty. See “Risk Factors — Risks Related to Our Intellectual Property — Failure to protect our intellectual property could substantially harm our business, operating results, and financial condition.”

Our trademark and copyright filings are intended to secure rights in our trademarks and copyrights for the purpose of strengthening enforcement against unauthorized third-party use of identical or confusingly similar marks to those of our marks for the same, overlapping and related goods, as to our trademarks, and infringing copyright content, as to our copyrights. Our trademark and copyright registrations can also be licensed or assigned to meet the needs of our business.

Government Regulation

Our business and our devices and platform are subject to numerous domestic and foreign laws and regulations covering a wide variety of subject matters. These include general business regulations and laws, as well as regulations and laws specific to providers of Internet-delivered streaming services and Internet-connected devices. New or modified laws and regulations in these areas may have an adverse effect on our business. The costs of compliance with these laws and regulations could be high and may increase in the future. We anticipate that several jurisdictions may, over time, impose greater financial and regulatory obligations on us. If we fail to comply with these laws and regulations, we may be subject to significant liabilities and other penalties. Additionally, compliance with these laws and regulations could, individually or in the aggregate, increase our cost of doing business, impact our competitive position relative to our peers, and otherwise have an adverse impact on our operating results.

Data Protection and Privacy

We are subject to various laws and regulations covering the privacy and protection of users’ data. Because we handle, collect, store, receive, transmit, transfer, and otherwise process certain information, which may include personal information, regarding our users and employees in the ordinary course of business, we are subject to federal, state and foreign laws related to the privacy and protection of such data. These laws and regulations, and their application to our business, are increasingly changing and expanding. Compliance with these laws and regulations, such as the California Consumer Privacy Act could affect our business, and their potential impact is unknown. Any actual or perceived failure to comply with these laws and regulations may result in investigations, claims and proceedings, regulatory fines or

19

penalties, damages for breach of contract, or orders that require us to change our business practices, including the way we process data.

We are also subject to breach notification laws in the jurisdictions in which we operate, and we may be subject to litigation and regulatory enforcement actions as a result of any data breach or other unauthorized access to or acquisition or loss of personal information. Any significant change to applicable laws, regulations, interpretations of laws or regulations, or market practices, regarding the processing of personal data, or regarding the manner in which we seek to comply with applicable laws and regulations, could require us to make modifications to our products, services, policies, procedures, notices, and business practices, including potentially material changes. Such changes could potentially have an adverse impact on our business.

Corporate History & Business Development

We were incorporated in Nevada on May 11, 2015, as Interlink Plus, Inc. On February 6, 2020, pursuant to the Agreement and Plan of Merger, dated January 3, 2020 (the “Merger Agreement”), by and among the Company, the Company’s wholly owned subsidiary, Loop Media Acquisition, Inc., a Delaware corporation (“Merger Sub”), and Loop Media, Inc., a Delaware corporation incorporated on May 18, 2016 (“Predecessor Loop”), Merger Sub merged with and into Predecessor Loop, with Predecessor Loop surviving the merger and becoming a wholly-owned subsidiary of the Company (the “Merger”). The business we operated prior to February 2020 was sold and is no longer part of our business. The following discussion of the history of the “Loop” business includes our business as operated by Predecessor Loop prior to February 2020 and as operated by us thereafter.

| ● | 2016 — Founding of Loop — Loop was founded in 2016 by Jon Niermann (our Chief Executive Officer), Liam McCallum (our Chief Product and Technical Officer), and Shawn Driscoll (our GM, Affiliate Distribution) with the intention of developing and then delivering a streaming video music service to consumers on their mobile devices. |

| ● | 2016 — Loop Acquires 20% of ScreenPlay — In 2016, Loop acquired 20% of the outstanding shares of ScreenPlay, which operated a business-focused computer-based video service providing music video and other content to business venues. ScreenPlay owned a vast short-form video content library that contained over 500,000 videos, including music videos and movie and TV trailers. |

| ● | 2019 — Loop Acquires Remaining 80% of ScreenPlay — In 2019, Loop acquired the remaining 80% of outstanding shares of ScreenPlay, and ScreenPlay’s content became the foundation of the Loop business. Loop acquired ScreenPlay to obtain access to and ownership of ScreenPlay’s vast video content, which could then be delivered to Loop’s target retail clients, and to benefit from ScreenPlay’s relationships with the major music label companies whose licenses would be required to provide music video content to such retail clients. We also sought to leverage our technology and innovation to gain greater access to, and expand ScreenPlay’s business with OOH locations, which relied on costly computer hardware, long lead times for customer acquisition and high monthly subscription fees. Since the acquisition of ScreenPlay, we have continued to procure additional content, through acquisitions and licenses, to further grow our video library. |

| ● | February 2020 — Loop Business Becomes Part of a Public Reporting Company — In February 2020, as a result of the Merger with Predecessor Loop, we became an early-stage media company and acquired Predecessor Loop’s video streaming business and the management team of Predecessor Loop became our management team. We subsequently changed our name to “Loop Media, Inc.” and our trading symbol for our shares quoted on the over-the-counter market operated by OTC Markets to “LPTV.” |

| ● | December 2019 — October 2020 — Loop Player — We introduced the Loop Player in 2019 as a paid subscription service but didn’t experience substantive growth of our OOH business until the fourth quarter of 2020 when we made the Loop Player available for free to OOH locations. Coupled with our on-line marketing campaign and the introduction of our ad-supported service model, we experienced more significant growth in our OOH business starting in late 2020 and into 2021. |

| ● | November 2020 — Loop Media Studios — In November 2020, we formed, and appointed Andy Schuon as Head of Loop Media Studios. The formation of Loop Media Studios was intended to set the foundation for strong |

20

| content expansion we expect will allow our DOOH and consumer platforms to scale more efficiently. Loop Media Studios is responsible for all of our content and programming creation and acquisitions for both the OOH and D2C businesses. It is charged with bringing more structure to our content, underpinned by creation, curation, editorial and execution workstreams. |

| ● | May 2021 — Loop’s Advertising Revenue Model More Fully Implemented — In May 2021, we completed the first stages of integrating our advertising revenue business model into our operations to allow for greater delivery of programmatic advertising and the sale of our advertising inventory. In May 2021, we also hired Bob Gruters as Chief Revenue Officer to drive our revenue through increased sponsorship of our content, prioritizing programmatic advertising revenue. |

| ● | June 2020 — October 2021 — Leadership Team — Between June 2020 and October 2021, we added a Head of Loop Media Studios, Chief Revenue Officer, General Counsel, Chief Content & Marketing Officer, Head of Music and Chief Financial Officer to our leadership team. |

| ● | May 2022 — Partner Platforms — We launched our Partner Platforms business beginning in May 2022 with one partner on approximately 17,000 of the partner’s screens, and we have since added an additional 13,500 screens in a second partner’s digital platform, for a total of 30,500 screens in our Partner Platforms business as of September 30, 2022. We are looking to expand our customer base for this line of business over time. |

| ● | September 2022 – The September 2022 Offering, the Uplist – On September 26, 2022, we completed an underwritten public offering of our common stock at a public offering price of $5.00 per share (the “September 2022 Offering”). In connection with the September 2022 Offering, our common stock was approved for listing (the “Uplist”) on the NYSE American (the “NYSE American”) under the symbol “LPTV” and began trading on the NYSE American on September 22, 2022. |

Suppliers

We source our proprietary Loop Player from a third-party manufacturer. We believe the components and raw materials required for our Loop Player are readily available from a variety of sources. We have no long-term contracts or commitments for the supply of Loop Players.

Employees

We employed approximately 74 people as of December 1, 2022, 67 of whom were full-time employees and 7 of whom were hourly contract workers. None of our employees are represented by a union in collective bargaining with us. We believe that our employee relations are good.

21

ITEM 1A. RISK FACTORS.

Summary of Risk Factors

In addition to the other information contained in this Report, including the matters addressed under the heading “Forward-Looking Statements,” you should carefully consider all of the risks and uncertainties described in the section of this Report captioned “Item 1A. Risk Factors.” These risks include, but are not limited to, the following:

Risks Related to Our Financial Condition

| ● | We have a limited operating history on which you can evaluate our business and prospects. |

| ● | We have generated minimal revenues under our current business model, which makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance. |

| ● | We have incurred significant operating losses in the past, and we may not be able to generate sufficient revenue to be profitable, or to generate positive cash flow on a sustained basis. In addition, our revenue growth rate may decline. |

| ● | If we are unable to generate significant revenue or secure additional financing, we may be unable to implement our business plan and grow our business. |

| ● | We will require additional capital to support our business and objectives, and this capital might not be available on acceptable terms, if at all. |

| ● | We have entered into debt arrangements, including non-revolving and revolving lines of credit secured by all of our assets; as of December 1, 2022, we owed an aggregate of $12,296,755 in principal and accrued interest on our debt arrangements. This indebtedness could adversely affect our financial position and our ability to raise additional capital and prevent us from fulfilling our obligations. |

Risks Related to Our Business

| ● | If our efforts to attract prospective OOH clients and direct-to-customer users and to retain existing clients and users of our services are not successful, our growth prospects and revenue will be adversely affected. |

| ● | We must operate our business in compliance with the licenses that are required to provide our services. |

| ● | We face and will continue to face competition for ad-supported users, subscribers to our paid subscription services, and user listening time. |

| ● | We depend upon third-party licenses for substantially all of the content we stream and an adverse change to, loss of, or claim that we do not hold necessary licenses may materially adversely affect our business, operating results, and financial condition. |

| ● | We have no control over third-party providers of our content. The concentration of control of content by our major providers means that even one entity, or a small number of entities working together, may unilaterally affect our access to music video and other content. |

| ● | We are a party to many license agreements that are complex and impose numerous obligations upon us that may make it difficult to operate our business and provide all the functionality we would like for our services, and a breach of such agreements could adversely affect our business, operating results, and financial condition |

| ● | We are dependent on key distributors. The loss of any such key distributor or any delay or interruption in the distribution of our products or services could adversely impact our revenue and operations. |

| ● | The coronavirus COVID-19 pandemic or the widespread outbreak of any other communicable disease could materially and adversely affect our business, financial condition and results of operations. |

| ● | Our royalty payment scheme is complex, and it is difficult to estimate the amount payable under our license agreements. We may |

22

| underpay or overpay royalty amounts payable to others, which may harm our business. |

| ● | Minimum guarantees and advances required under certain of our license agreements may limit our operating flexibility and may adversely affect our business, operating results, and financial condition. |

| ● | Difficulties in obtaining accurate and comprehensive information necessary to identify the compositions embodied in music video sound recordings on our service and the ownership thereof may impact our ability to perform our obligations under our licenses, affect the size of our catalog that can be offered to clients and end-users, impact our ability to control content acquisition costs, and lead to potential copyright infringement claims. |

| ● | We face many risks associated with our international expansion, including difficulties obtaining rights to stream content on favorable terms. |

| ● | If we fail to effectively manage our expected growth, our business, operating results, and financial condition may suffer. |

| ● | Our business emphasizes rapid innovation and prioritizes long-term customer and user engagement over short-term financial condition or results of operations. That strategy may yield results that sometimes do not align with the market’s expectations. If that happens, our stock price may be negatively affected. |

| ● | If we fail to accurately predict, recommend, curate and play content that our clients and users enjoy, we may fail to retain existing clients and users and attract new clients and users in sufficient numbers to meet investor expectations for growth or to operate our business profitably. |

| ● | Expansion of our operations to deliver content beyond music videos subjects us to increased business, legal, financial, reputational, and competitive risks. |

| ● | If our security systems are breached, we may face civil liability and/or statutory fines, and/or enforcement action causing us to change our practices, and public perception of our security measures could be diminished, either of which would negatively affect our ability to attract and retain OOH clients, premium service subscribers, ad-supported users, advertisers, content providers, and other business partners. |

| ● | Changes in how network operators handle and charge for access to data that travel across their networks could adversely impact our business. |

| ● | Our services and software may contain undetected software bugs or vulnerabilities, which could manifest in ways that could seriously harm our reputation and our business. |

| ● | Interruptions, delays, or discontinuations in service arising from our own systems or from third parties could impair the delivery of our services and harm our business. |

| ● | User metrics and other estimates could be subject to inherent challenges in measurement, and real or perceived inaccuracies in those metrics may seriously harm and negatively affect our reputation and our business. |

| ● | We face risks, such as unforeseen costs, and potential liabilities in connection with content we license and/or distribute through our services. |

| ● | Various regulations as well as self-regulation related to privacy and data security concerns pose the threat of lawsuits, regulatory fines and other liability, require us to expend significant resources, and may harm our business, operating results, and financial condition. |

| ● | Failure to manage our relationship with the manufacturer of our Loop Players, the disruption of the supply chain for Loop Players or our failure to timely order new Loop Players could harm our business, operating results, and financial condition. |

| ● | We rely on advertising revenue to monetize our services, and any failure to convince advertisers of the benefits of advertising on our services in the future could harm our business, operating results, and financial condition. |

| ● | The market for programmatic advertising in the digital out-of-home market is evolving. If this market develops slower or differently than we expect, our business, operating results and financial condition could be adversely affected. |

| ● | We derive a significant portion of our revenues from advertisements. If we are unable to continue to compete for these advertisements, or if any events occur that negatively impact our relationships with advertising networks, our advertising revenues and operating results would be negatively impacted. |

23

| ● | Our business is sensitive to a decline in advertising expenditures, general economic conditions and other external events beyond our control. |

| ● | We depend on highly skilled key personnel to operate our business, and if we are unable to attract, retain, and motivate qualified personnel, our ability to develop and successfully grow our business could be harmed. |

| ● | We have acquired and invested in, and may continue to acquire or invest in, other companies or technologies, which could divert management’s attention and otherwise disrupt our operations and harm our operating results. We may fail to acquire or invest in companies whose market power or technology could be important to the future success of our business. |

| ● | If our acquired intangible assets become impaired in the future, we may incur significant impairment charges. |

| ● | Our operating results may fluctuate, which makes our results difficult to predict. |

| ● | In connection with the preparation of our financial statements for the twelve months ended September 30, 2021, and for the nine months ended June 30, 2022, we identified material weaknesses in our internal control over financial reporting, and if we fail to implement and maintain effective internal control over financial reporting, our ability to accurately and timely report our financial results could be adversely affected. |

Risks Related to Our Intellectual Property

| ● | Assertions by third parties of infringement or other violations by us of their intellectual property rights could harm our business, operating results, and financial condition. |