Exhibit 3.1

Exhibit 3.1

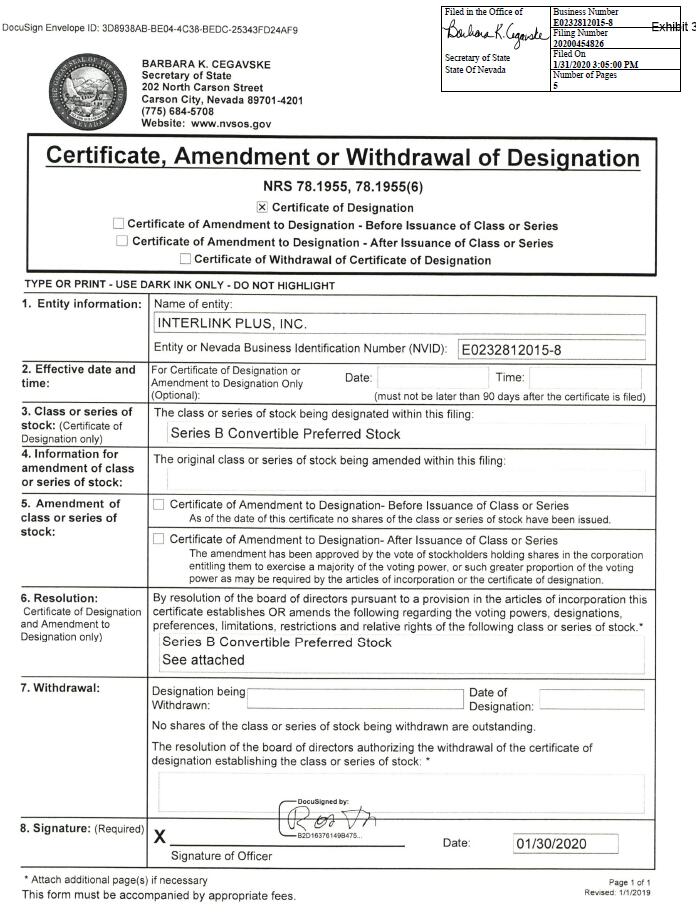

| Certificate, Amendment or Withdrawal of Designation NRS 78.1955, 78.1955(6) [X] Certificate of Designation |

1. Entity information:

Name of entity: INTERLINK PLUS, INC.

Entity or Nevada Business Identification Number (NVID): E0232812015-8

2. Effective date and time:

3. Class or series of stock:

The class or series of stock being designated within this filing: Series B Convertible Preferred Stock

4. Information for amendment of class or series of stock:

5. Amendment of class or series of stock:

6. Resolution:

By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes OR amends the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock.*

Series B Convertible Preferred Stock

See Attached

7. Withdrawal:

8. Signature:

Signature of Officer or Authorized Signer, Title: /s/ Roger Tichenor, CEO

Date: 01/30/2020

Exhibit 3.1

INTERLINK PLUS, INC.

CERTIFICATE OF DESIGNATION

OF

SERIES B CONVERTIBLE PREFERRED STOCK

PURSUANT TO NEVADA REVISED STATUTES 78.1955

The undersigned, Roger Tichenor, does hereby certify that:

1. Such individual is the CEO of Interlink Plus, Inc., a Nevada corporation (the "Corporation").

2. The Corporation's Articles of Incorporation authorize the Corporation to issue 25,000,000 shares of Preferred Stock, $0.0001 par value per share, in one or more series.

3. The Corporation's Articles of Incorporation provide that the voting powers, designations, preferences, limitations, restrictions, and relative, participating, optional and other rights, and the qualifications, limitations, or restrictions thereof, of the Corporation's Preferred Stock shall be prescribed by resolution of the board of directors of the Corporation, except for the Series A Convertible Preferred Stock which is set forth in the Articles of Incorporation.

4. The following resolutions were duly adopted by the board of directors of the Corporation in accordance with the Corporation's Articles of Incorporation and Nevada Revised Statutes 78.1955:

WHEREAS, the Articles of Incorporation of the Corporation ("Articles") provide for a class of its authorized capital stock known as preferred stock, consisting of 25,000,000 shares, $0.0001 par value per share, issuable from time to time in one or more series;

WHEREAS, the voting powers, designations, preferences, limitations, restrictions, and relative, participating, optional and other rights, and the qualifications, limitations, or restrictions thereof, of the Corporation's 5,000,000 shares of Series A Convertible Preferred Stock is set forth in the original Articles;

WHEREAS, the board of directors of the Corporation is authorized under the Articles to provide by resolution for the issuance of additional series of preferred stock and to establish, from time to time, the number of shares to be included in each such series, and to fix the designation, powers, preferences and rights of the shares of each such series and any qualifications, limitations or restrictions thereon; and

WHEREAS, the board of directors deems it to be advisable and in the best interests of the Corporation and its shareholders to designate a new series of preferred stock and to fix the rights, preferences, restrictions and other matters relating to such new series of preferred stock.

NOW, THEREFORE, BE IT RESOLVED, that there shall be created, out of the 25,000,000 authorized shares of preferred stock of the Corporation, a new series of preferred stock, which series shall have the following powers, designations, preferences and relative participating, optional and other special rights, and the following qualifications, limitations and restrictions:

Exhibit 3.1

TERMS OF SERIES B CONVERTIBLE PREFERRED STOCK

Section 1. Designation, Amount and Par Value. The series of preferred stock is hereby designated as Series B Convertible Preferred Stock and the number of shares so designated shall be 5,000,000 (which shall not be subject to increase without the written consent of a majority of the holders of Series B Convertible Preferred Stock). Each share of Series B Convertible Preferred Stock shall have a par value of $0.0001 per share.

Section 2. Rank. Except as otherwise provided herein, Series B Convertible Preferred Stock shall, with respect to rights on liquidation, winding up and dissolution, rank pari passu to the Corporation's common stock, par value $0.0001 per share, and stock of any other class of securities into which such securities may hereafter be reclassified or changed ("Common Stock") and the Corporation’s designated Series A Convertible Preferred Stock.

Section 3. Dividends. The holders of shares of Series B Convertible Preferred Stock have no dividend rights except as may be declared by the board of directors of the Corporation (the "Board") in its sole and absolute discretion, out of funds legally available for that purpose.

Section 4. Liquidation Preference.

(i) In the event of the liquidation, dissolution or winding up of the affairs of the Corporation, whether voluntary or involuntary (each, a "Liquidation"), the holders of shares of Series B Convertible Preferred Stock then outstanding shall be entitled to receive, out of the assets of the Corporation available for distribution to its shareholders, an amount equal to $1.00 per share of Series B Convertible Preferred Stock before any payment shall be made or any assets distributed to the holders of Common Stock or Series A Convertible Preferred Stock. If the assets of the Corporation are not sufficient to pay in full the amount payable to the holders of outstanding shares of the Series B Convertible Preferred Stock as to rights on Liquidation with the Series B Convertible Preferred Stock, then all of said assets will be distributed among the holders of the Series B Convertible Preferred Stock and the other classes of stock ranking pari passu with the Series B Preferred Stock, if any, ratably in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full.

(ii) A sale of all or substantially all of the Corporation's assets or an acquisition of the Corporation by another entity by means of any transaction or series of related transactions (including, without limitation, a reorganization, consolidated or merger) that results in the transfer of fifty percent (50%) or more of the outstanding voting power of the Corporation, shall not be deemed to be a Liquidation.

Section 5. Voting. The holders shall have the right to cast one hundred (100) votes for each share of Series B Convertible Preferred Stock held of record on all matters submitted to a vote of holders of the Common Stock, including the election of directors, and all other matters as required by law. There is no right to cumulative voting in the election of directors. The holders of Series B Preferred Stock shall vote together with all other classes and series of Common Stock as a single class on all actions to be taken by the holders of Common Stock, except to the extent that voting as a separate class or series is required by law.

Section 6. Optional Conversion of Series B Convertible Preferred Stock. The holders of Series B Convertible Preferred Stock shall have conversion rights as follows:

(i) Conversion Right. Each share of Series B Convertible Preferred Stock shall be convertible at the option of the holder thereof and without the payment of additional consideration by the holder thereof, at any time, into shares of Common Stock on the Optional Conversion Date (as hereinafter defined) at a conversion rate of one hundred (100) shares of Common Stock (the "Conversion Rate") for every one (1) share of Series B Convertible Preferred Stock.

Exhibit 3.1

(ii) Mechanics of Optional Conversion. To effect the optional conversion of shares of Series B Convertible Preferred Stock, any holder of record shall make a written demand for such conversion (for purposes of this Designation, a "Conversion Demand") upon the Corporation at its principal executive offices setting forth therein: (a) the certificate or certificates representing such shares, (b) the number of shares of Series B Convertible Preferred Stock such holder wants to convert into Common Stock at the Conversion Rate; and (c) the proposed date of such conversion, which shall be a business day not less than fifteen (15) nor more than thirty (30) days after the date of such Conversion Demand (for purposes of this Designation, the "Optional Conversion Date"). Within five days of receipt of the Conversion Demand, the Corporation shall give written notice (for purposes of this Designation, a "Conversion Notice") to the holder setting forth therein (A) the address of the place or places at which the certificate or certificates representing any shares not yet tendered are to be converted are to be surrendered; and (B) whether the certificate or certificates to be surrendered are required to be endorsed for transfer or accompanied by a duly executed stock power or other appropriate instrument of assignment and, if so, the form of such endorsement or power or other instrument of assignment. The Conversion Notice shall be sent by electronic mail or first class mail, postage prepaid, to such holder at such holder's email or street address as may be set forth in the Conversion Demand or, if not set forth therein, as it appears on the records of the stock transfer agent for the Series B Convertible Preferred Stock, if any, or, if none, of the Corporation. On or before the Optional Conversion Date, each holder of the Series B Convertible Preferred Stock to be converted shall surrender the certificate or certificates representing such shares, duly endorsed for transfer or accompanied by a duly executed stock power or other instrument of assignment, if the Conversion Notice so provides, to the Corporation at any place set forth in such notice or, if no such place is so set forth, at the principal executive offices of the Corporation. As soon as practicable after the Optional Conversion Date and the surrender of the certificate or certificates representing such shares, the Corporation shall issue and deliver to such holder, or its nominee, at such holder's address as it appears on the records of the stock transfer agent for the Series B Convertible Preferred Stock, if any, or, if none, of the Corporation, a certificate or certificates for the number of whole shares of Common Stock issuable upon such conversion in accordance with the provisions hereof.

(iii) No Fractional Shares. No fractional shares of Common Stock or scrip shall be issued upon conversion of shares of Series B Convertible Preferred Stock. In lieu of any fractional share to which the holder would be entitled based on the number of shares of Series B Convertible Preferred Stock held by such holder, the Corporation shall issue a number of shares to such holder rounded up to the nearest whole number of shares of Common Stock. No cash shall be paid to any holder of Series B Convertible Preferred Stock by the Corporation upon conversion of Series B Preferred Convertible Stock by such holder.

(iv) Reservation of Stock. The Corporation shall at all times when any shares of Series B Preferred Convertible Stock shall be outstanding, reserve and keep available out of its authorized but unissued Common Stock, such number of shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Series B Convertible Preferred Stock. If at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all outstanding shares of the Series B Convertible Preferred Stock, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose.

(v) Issue Taxes. The converting holder of Series B Convertible Preferred Stock shall pay any and all issue and other non-income taxes that may be payable in respect of any issue or delivery of shares of Common Stock on conversion of shares of Series B Convertible Preferred Stock.

Exhibit 3.1

RESOLVED, FURTHER, that the CEO, the president or any other officer of the Corporation be and they hereby are authorized and directed to prepare and file this Certificate of Designation of Series B Convertible Preferred Stock in accordance with the foregoing resolution and the provisions of the Nevada Revised Statutes.

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Designations of Series B Convertible Preferred Stock as of January 30, 2020.

INTERLINK PLUS, INC.

By: /s/ Roger Tichenor

Roger Tichenor, CEO