UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

Commission File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation) | (I.R.S Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

The aggregate market value of the voting and non-voting common stock held by non-affiliates computed by reference to the price at which the common stock was last sold, or the average bid and asked price of such common stock, as of March 31, 2021, was $

As of December 27, 2021, the registrant had

TABLE OF CONTENTS

3

FORWARD-LOOKING STATEMENTS

Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements include, among others, those statements including the words “believes”, “anticipates”, “expects”, “intends”, “estimates”, “plans” and words of similar import. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking statements are based on our current expectations and assumptions regarding our business, potential target businesses, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We caution you therefore that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees or assurances of future performance. You should understand that many important factors, in addition to those discussed or incorporated by reference in this report, could cause our results to differ materially from those expressed in the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include changes in local, regional, national, or global political, economic, business, competitive, market (supply and demand) and regulatory conditions and the following:

| ● | Our ability to raise capital when needed and on acceptable terms and conditions; |

| ● | Our ability to attract and retain management with experience in digital media including digital video music streaming, and similar emerging technologies; |

| ● | Our ability to negotiate, finalize and maintain economically feasible agreements with the major and independent music labels, publishers and performance rights organizations; |

| ● | Our expectations regarding market acceptance of our products in general, and our ability to penetrate the digital video music streaming market in particular; |

| ● | The scope, validity and enforceability of our and third-party intellectual property rights; |

| ● | Our ability to comply with governmental regulation; |

| ● | The intensity of competition; |

| ● | The effects of the ongoing pandemic caused by the spread of the novel coronavirus COVID-19 (“COVID-19”) and our business customers ability to service their customers in out of home venues, especially considering government-imposed business shutdowns and capacity limitations; |

| ● | Changes in the political and regulatory environment and in business and fiscal conditions in the United States and overseas; |

| ● | Our ability to attract prospective users and to retain existing users; |

| ● | Our dependence upon third-party licenses for sound recordings and musical compositions; |

| ● | Our lack of control over the providers of our content and their effect on our access to music and other content; |

| ● | Our ability to comply with the many complex license agreements to which we are a party; |

| ● | Our ability to accurately estimate the amounts payable under our license agreements; |

4

| ● | The limitations on our operating flexibility due to the minimum guarantees required under certain of our license agreements; |

| ● | Our ability to obtain accurate and comprehensive information about music compositions in order to obtain necessary licenses or perform obligations under our existing license agreements; |

| ● | Potential breaches in security of systems that house proprietary data. |

| ● | Assertions by third parties of infringement or other violations by us of their intellectual property rights; |

| ● | Competition for users and user listening time; |

| ● | Our ability to generate sufficient revenue to be profitable or to generate positive cash flow on a sustained basis; |

| ● | Our ability to accurately estimate our user metrics; |

| ● | Risks associated with manipulation of stream counts and user accounts and unauthorized access to our services; |

| ● | Changes in legislation or governmental regulations affecting us; |

| ● | Ability to hire and retain key personnel; |

| ● | Our ability to maintain, protect and enhance our brand; |

| ● | Risks associated with our international expansion, including difficulties obtaining rights to stream music on favorable terms; |

| ● | Risks relating to the acquisition, investment and disposition of companies or technologies; |

| ● | Dilution resulting from additional share issuances; |

| ● | Tax-related risks; |

| ● | The concentration of voting power among our founders who have and will continue to have substantial control over our business; |

| ● | International, national, or local economic, social or political conditions, and |

| ● | Risks associated with accounting estimates, currency fluctuations and foreign exchange controls. |

Other sections of this report describe additional risk factors that could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time, and it is not possible for our management to predict all risk factors and uncertainties, nor are we able to assess the impact of all of these risk factors on our business or the extent to which any risk factor, or combination of risk factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks and others described under the section “Risk Factors” below are not exhaustive.

Given these uncertainties, readers of this Transition Report on Form 10-KT (“Transition Report”) are cautioned not to place undue reliance on such forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

5

PART I

ITEM 1. BUSINESS.

Overview

We are a multichannel digital video platform media company that uses marketing technology, or “MarTech,” to generate our revenue and offer our services. Our technology and vast library of videos and licensed content enables us to curate and deliver short-form videos to our out-of-home (“OOH”) dining, hospitality, retail and other customers to enable them to inform, entertain and engage their customers. Our technology provides OOH customers and third-party advertisers with a targeted marketing and promotional tool for their products and services and allows us to measure the number of potential viewers of such advertising and promotional materials. In addition to providing services to OOH venue operators, we provide our services direct to consumers (“D2C”) in their homes and on their mobile devices.

We offer self-curated music video content licensed from major and independent record labels, as well as movie, television and video game trailers, kid-friendly videos, viral videos, drone footage, news headlines, and lifestyle and atmospheric channels. We believe we are the only service in the United States that has OOH and D2C licenses with all three major music labels, Universal Music Group (“Universal”), Sony Music Entertainment (“Sony”) and Warner Music Group (“Warner” and collectively with Universal and Sony, the “Music Labels”). These licenses allow us to provide music video content in both the OOH and D2C markets. Our OOH services are complimented by our mobile app (the “Loop App”), which allows users to follow each other, share their locations and playlists, view activity, and signal support for a music video.

We curate content into playlists for OOH locations and into streaming channels for delivery to our over-the-top (“OTT”) platform customers and our mobile application users. Our digital platform service seeks to surround and engage consumers with a diverse offering of video content on their chosen digital screen wherever they are located. Our services include both an ad-supported service, which offers content on a free or unpaid advertising supported basis, and a premium service, which offers content on a paid subscription basis. We deliver our service to OOH locations primarily through our proprietary Loop Media-designed “small-box” streaming Android media player (the “Loop Player”) and we deliver our services direct to consumers primarily through our fully functional and operational Loop App and across OTT streaming platforms on connected TVs (“CTVs”).

Industry

Consumer Adoption of Streaming Services

In recent years, the video streaming services industry experienced, and is expected to continue to experience, significant growth, as entertainment is delivered to consumers across an increasing array of digital platforms and services. According to data (the “Statista Data”) from Statista, Inc. (“Statista”), revenue from the transmission and sale of video content over the internet (“VCOI”) is projected to reach $76.7 billion in 2021 and rise to $113.9 billion by 2025, a 10.4% compounded annualized growth rate (“CAGR”), with free (ad-supported) OTT users expected to increase from 213.2 million users in 2020 to a projected 225.4 million users in 2025. According to the Statista Data, the largest revenue segment for VCOI is revenue derived from OTT video advertising (all advertising-financed moving image content, from premium to user-generated), with revenue of $34.3 billion in 2020, and projected revenue of $40.6 billion in 2021, $46.5 billion in 2022 and $63.3 billion in 2025, representing a CAGR of 13.0% over that period. According to Activate (based on information from Statista), the number of connected TV households (households for which at least one person of any age used the internet through a CTV at least once per month) in the United States is expected to increase from 85 million in 2017 to 113 million in 2024.

Digital-Out-of-Home Advertising

In 2020, we primarily began using a free, ad-supported revenue model for our OOH business and believe our ad-supported services will be the primary driver of our revenue growth as demand for digital-out-of-home advertising is expected to grow. According to Statista Data, overall advertising spend in the United States was $268.86 billion in 2011

6

and is expected to grow to $294.09 billion in 2021 and $364.38 billion in 2025. 80% of digital advertising (in 2020) was delivered to media outlets through programmatic advertising. Programmatic advertising is a system that automates the processes and transactions involved with purchasing and dynamically placing ads on websites, apps or other digital delivery systems. Programmatic advertising makes it possible to purchase and place ads, including targeted advertising content, in seconds. According to the Statista Data, ad spending in the OOH space in the United States was $6.49 billion in 2020 and is expected to increase to $7.21 billion in 2021 and $9.00 billion in 2025.

Our Revenue Model

Our ad-supported and subscription-based services are separate offerings but work together to support our business. Given the expected growth in the digital OOH advertising market, coupled with the preferable economics to the Company of an ad-supported business model, we encourage our customers to choose our ad-supported services over our subscription services. While our ad-supported services are generally associated with higher margins, we provide a subscription service for OOH customers that are seeking an ad-free content offering.

MarTech

MarTech, the intersection of marketing and technology, fuels our growth and leverages data and analytics to expand our points of distribution and advertising revenue.

Distribution. Our current customer acquisition strategy is focused on marketing our Loop Player to business through social media and other online mediums. We seek to optimize our customer acquisition and the distribution of our Loop Players by analyzing various data, including our return on marketing investments. When analyzing the success of our marketing investments, we examine the number of sales leads obtained from online platforms and the conversion of leads into high quality customers. We continuously analyze the engagement with, and success of, our creative advertising content and modify our messaging to improve customer acquisition.

Advertising Revenue. We intend to increase revenue by leading with programmatic advertising, an automated measurement process that manages the sales of our advertising inventory. Today, most digital advertising is programmatic advertising, with digital OOH advertising comprising a small portion of the overall market. While we strive to establish direct advertising deals with advertisers, a significant part of our current advertising revenue is purposely secured through programmatic advertising. Our yield optimization strategies look to leverage data analytic and other techniques to maximize the value of our digital advertising inventory. We intend to optimize the combination of our ad impressions, cost per impression and the percentage of our ad inventory filled by advertisers, while balancing our customers’ experience

7

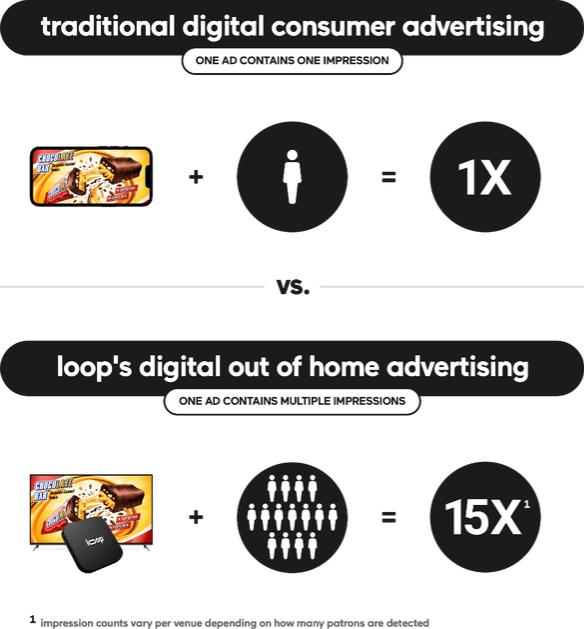

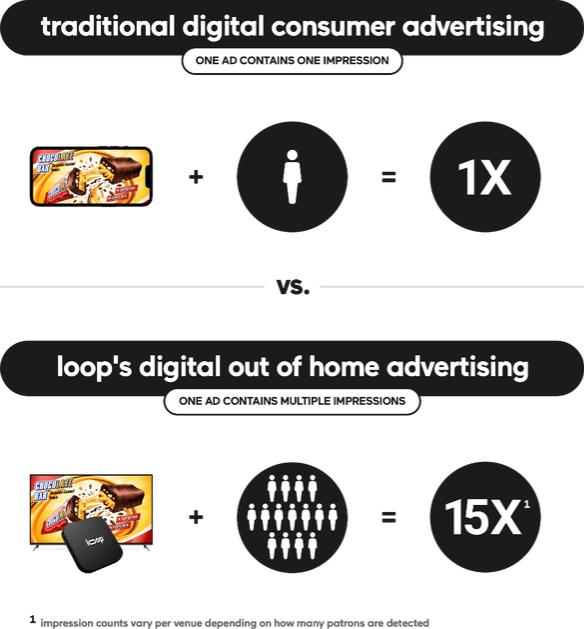

by limiting the number of ads delivered during any given period. Our Loop Player is designed to allow us to multiply OOH revenue in certain locations, as outlined below:

8

Loop Player

The Loop Player is at the heart of our revenue model and its technology enables us to communicate and interact with OOH locations, advertisers, and OOH customers:

| ● | OOH Locations. The Loop Player allows OOH customers to program their in-store monitors and audio systems to schedule playlists depending on the time of day, promote their products or services through digital signage and deliver company-wide messages to staff in back-office locations. Business owners can filter content based on ratings or explicit language and can control the genres of videos in their programs. The Loop Player caches and encrypts our content, thereby supplying uninterrupted play for up to 12 hours in the event of an internet disruption. |

| ● | Advertising and Content Partners. Our Loop Player works with our technology, software and servers to determine the number of ad impressions available for programmatic advertising, which can be filled in real-time, seconds before ads are played. Our Loop Player delivers content and advertising to venues and our technology allows us to record and report video content played (for reporting to content providers) and advertising content played (for reporting to our advertising demand partners and advertisers). In particular, our technology allows us to track when, where and how long content is played, and measure approximately how many consumers were in position to view the content or advertisement. The Loop Player’s Wi-Fi and |

9

| Bluetooth capabilities allow us to determine the number of potential viewers at a given location, which can provide us with a revenue multiplier, as we are able to increase advertising revenue at high-volume locations. This “multiplier effect” is possible due to the Loop Player’s ability to detect, using Bluetooth and Wi-Fi technology, the number of consumer mobile devices within reach of a Loop Player in an OOH location which provides advertisers with a proxy for the number of potential viewers of a particular ad at any given time. |

| ● | OOH Customers. We are seeking to further develop the interactivity between the Loop Player and the customers in OOH venues. This may take different forms, such as offering a simple thumbs up or thumbs down function, displaying the number of customer votes for a given piece of content, and downloading of menus from the screens and other functions. This will require further development of our mobile application in the future. |

| ● | Loop Media. We are able to consistently monitor the preferences of the customers of our OOH customers and venue operators through our Loop Player. Our Loop Player allows us to collect specific information and data on content played, views, location, and location type, enabling us to effectively measure demand. These capabilities allow us to make informed decisions around which type of content to acquire or develop, as well as identify new market opportunities. |

10

Our Platform

The following table sets forth our customer targets, delivery method, preferred revenue model and the associated content for our services:

CUSTOMER | DELIVERY METHOD | PREFERRED REVENUE MODEL | CONTENT |

OOH Venue | Loop Player | Ad-supported service | ● All forms of content, including music video and other content ● Curated playlists and channels |

Consumer Connected TVs | OTT Platforms and Loop App | Ad-supported service | ● Primarily music videos ● Not all of our music content can be streamed ● Non-music video content is currently limited, but we intend to expand this category |

Consumer Mobile Devices | Loop App | Subscription service | ● Music videos and kid-friendly content only ● Curated playlists and channels ● Videos on demand for subscription service |

OOH Locations

The foundation of our business model is built around the OOH experience, with a focus on distributing licensed music videos to public-facing businesses and venues. Our OOH offering has supported hospitality and retail businesses for over 20 years, originally through ScreenPlay, which we acquired in 2019. Since the acquisition of ScreenPlay, we have primarily focused on acquiring OOH customers throughout the United States.

Most locations deliver visual content to their customers by use of cable TV boxes and computer-based audio video equipment, which requires significant investment and cost to the venue operator. Capital investment in equipment has historically been a barrier for many businesses to provide visual entertainment to their customers. Unlike consumers in their homes, who have been more willing in recent years to invest in CTVs and streaming services, businesses generally have been slower in adopting lower cost streaming options.

To gain greater access, and expand our business with, OOH venue operators, we developed our proprietary Loop Player. The Loop Player is easy to set up and allows content to be streamed on multiple television sets. We believe our Loop Player and free, ad-supported service has significantly reduced the cost of specialty equipment and visual entertainment for venue operators.

The Loop Player was introduced in a limited rollout in early 2020, with a more formal rollout during the fourth quarter of 2020. We believe the COVID-19 pandemic, which caused many businesses to shut down or reduce capacity, has accelerated business owners’ demand for CTVs and streaming services to reduce their costs. For this reason, we believe the introduction of our Loop Player, coupled with our switch to a free ad-supported business model has contributed to the growth in 2021 of our OOH business customers. In 2021, our customer base expanded beyond our typical hospitality-based customers to smaller venues, franchisees and venues that service non-hospitality industries, like pet stores, doctors’ offices and other non-traditional venues.

We expect revenue from our OOH ad-supported service to increase to a greater extent than our revenue from our other services. This is partly due to our ongoing efforts to add new OOH locations to our distribution network, which

11

increases the number of Loop Players in the market and, in turn, the number of ad impressions available for advertisers to fill with paid advertisements and sponsorships. In addition, our OOH ad-supported service using the Loop Player allows us, in certain circumstances, to present a greater number of ad impressions per OOH location to an advertiser than would typically be associated with a single OOH location. This “multiplier effect” is possible due to the Loop Player’s ability to detect, using Bluetooth and WiFi technology, the number of consumer mobile devices within reach of a Loop Player in an OOH location, which provides advertisers with a proxy for the number of potential viewers of a particular ad at any given time. This contrasts with other OOH technology that is not capable of providing data on the number of persons in an OOH location and in which advertisers pay for one ad impression per ad in an OOH location, regardless of the number of potential viewers in that location. This also contrasts with our D2C services where advertisements are considered to be viewed by one person on their individual mobile device or on a CTV in their home.

D2C

Consumer Connected TVs

Our OTT business provides our OTT platform customers, such as Roku, TiVo, and DistroTV, with music videos and other video content, providing their subscribers and customers with access to certain videos in our library. Our service to OTT platform providers has been primarily ad-supported as many of the providers run a free advertising supported television, or FAST, business model for channels on their services. Not all of our music video content is available to our OTT customers. We also have a consumer CTV app that can be downloaded on CTVs and on which consumers can view certain of our content. Almost all of the viewers of our content on CTVs view our content on our channels delivered through OTT platforms rather than on our CTV consumer app.

Consumer Mobile Devices

We developed the Loop App for the distribution of our music videos and kid-friendly content. The Loop App allows our users to directly interact with our channels and playlists on their smart phones, tablets, and other digital devices, providing advertisers with additional mediums to reach consumers. Our premium users are provided enhanced features to search for titles of music videos and artists, request music videos and create personalized playlists. Additionally, through our subscription service, we provide social features that allow users to follow each other, share their locations and playlists, view activity, signal support for a particular music video, and listen to other users “Loops.” We initially launched the Loop App in mid-2020; however, we have not promoted or advertised it in any meaningful way. As we continue to grow our OOH business and distribute additional Loop Players, we believe the Loop App will enhance our interactivity with businesses and their customers, and in turn, influence the content we develop and acquire.

Our Competitive Strengths

Diversified Content Library, including Music Videos

We believe our music video library is one of the largest in the world and gives us an advantage over many of our competitors. Our music video library contains videos dating back to the 1950s, appealing to generations of music-lovers, with the newest videos directly obtained from the Music Labels. Older music video libraries are more difficult to obtain, as there is generally no central database from which to acquire such videos. Additionally, the individual music labels who have rights over portions of such videos do not easily and readily provide them to those seeking to acquire them. We have strategically secured access to our music video content through our license agreements with the individual Music Labels. We believe we are the only service in the United States who has licenses with all three major Music Labels to provide music video content in both the OOH and D2C markets.

Efficient Content Curation

We believe we are able to produce engaging video content by curating our own and third party-content at relatively low production cost. We do not currently produce a meaningful amount of original content, which can be expensive and time consuming. In contrast to many streaming platforms, we curate existing content from our video library and content licensed from third parties. The curation of our content from our owned and leased libraries eliminates the

12

costly and lengthy production process associated with creating original content. Therefore, we are able to consistently innovate, update, and enhance our content offerings in a cost-effective and timely manner. We believe we were able to launch more channels than any other media company on OTT platforms during 2020.

National Distribution and Reach

We distribute our services across thousands of OOH locations, audio and video streaming platforms, and mobile and connected TV applications. We had 5,791 quarterly active users (“QAU”) across North America for the quarter ended September 30, 2021, and our channels are available to millions of consumers on OTT platforms and are currently accessible in over 400,000 hotel rooms, serving both the OOH and D2C markets, respectively. We have recently hired salespeople to engage in direct marketing for our OOH business across various regions, including the East Coast, West Coast, South. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Key Performance Indicator” for a description of QAUs.

Technology Based Business Model

All of our key software and the design of our Loop Player and consumer apps has been developed in-house by us. We have built our services and platform with a view to the future, focusing on where we believe the digital OOH and consumer streaming and mobile devices markets are and will be for the foreseeable future. The Loop Player is ideal for OOH location operators looking to “cut the cord” from their old business models. This allows our OOH customers to save costs and provides them with a greater ability to customize and schedule content to fit their venues. We use digital marketing technology, or “MarTech,” to generate revenue, market our services and fuel our business. Additionally, we believe we can attract key employees from across geographies as we operate almost entirely remotely in support of our culture of technology and efficiency. Our use of technology in most aspects of our business from marketing, to distribution, content curation, sales, customer service and other areas, allows us to leverage our existing employees as we continue to scale up our business.

Established Foundation Supported by Industry Tailwinds

Our technology stack, ad-supported revenue model and music video library are the backbone of our business. We believe this established foundation places us in a better position than many peers to benefit from any industry tailwinds in the digital OOH advertising market. Because our foundation has been built with a view to where we believe the OOH content delivery and digital marketing trends are headed, we believe we are better positioned than many of our competitors who might have to re-work their technology and revenue models to better align with these trends. We believe our programmatic advertising in the OOH market will support our revenue into the future.

Passionate and Experienced Management Team

Our seasoned management team is founder-led and has more than 100 years of combined media and technology experience. Our executive team has previous experience at some of the most well recognized entertainment companies in the world, including Walt Disney, Universal Music, MTV, VH1, CBS, Sony, Viacom, Time Warner, among others.

Our Growth Strategies

Our growth strategies are focused on monetizing and growing our content library and are guided by the following five pillars:

Increase Marketing of Loop Player. We have found online digital advertising to be a successful customer acquisition strategy and believe there is a direct correlation between digital marketing spend and business demand for the Loop Player. In addition to digital advertising viewed by individual businesses, we also intend to leverage our internal sales team to increase our direct marketing efforts to promote our Loop Player and services to large, national or regional, franchisee or corporate owned businesses.

13

Diversify Customer Base. We believe the introduction of our Loop Player and shift towards an ad-supported service model has contributed to the growth of our OOH customer base and related revenues. Our customer base has expanded beyond our typical hospitality, food and beverage and gym customers, as we have experienced an increase in business engagement from smaller venues, franchisees, and businesses that service other industries. This expansion has given us greater insight into the viewing habits of a diverse customer base and the demand for some of our non-music video content thereby enabling us to develop and curate content that continues to respond to consumer demand.

Expand our Non-Music Video Content. Our music video library is the foundation of our business but, in certain instances, has lower margins due to the licensing fees of the Music Labels and other rights holders. In addition, certain OOH locations are looking for a broader or more targeted content offering than pure music videos. Since the acquisition of ScreenPlay’s music video library in 2019, we have sought to expand our non-music video content through licensing, acquisitions and our own development. Non-music content, in certain instances, provides better economics to us than music video content. For this reason, we seek to expand our non-music offerings, which entails the addition of entertainment, lifestyle, and information channels.

Optimize Advertising Sales and Sponsorships. We aim to optimize our advertising sales by using technology and short-term, third-party consultants, to collect data and employ analytics. Similarly, we plan on continuing to optimize our programmatic revenue through MarTech data and analytics. In conjunction with these efforts, we recently expanded our advertising sales team to focus on advertising sales directly to companies that seek to advertise on our platform and to companies that are interested in providing sponsorship of our content. Through such arrangements, we may receive payments from a company in return for allowing such company to be associated with one of our channels, playlists, other content or company events.

International Expansion. We are exploring international expansion, as we believe the provision of video content in the non-U.S. OOH and D2C markets is underserved. In 2020 we began pursuing these growth initiatives by launching the Loop App in Mexico, and in 2021, we acquired EON Media, which produces a weekly syndicated radio program targeted across Asia. Over time, we plan to be opportunistic exploring ways to potentially expand in Asia, certain countries in South America, Canada and Europe.

Our Content

Content Acquisition

Music Videos. Although we own copies of the music videos that we deliver to our customers, we must secure the rights to stream the video, the sound recordings, and the musical compositions embodied therein (i.e., the musical notes and the lyrics). To do so we enter into license agreements to obtain licenses from rights holders such as record labels, music publishers, performance rights organizations, collecting societies, and other copyright owners or their agents, and pay royalties to such parties or their agents.

We currently have licenses and agreements with multiple parties to distribute our music videos for our consumer customers in the United States, Canada, and Mexico. We also have longstanding limited, non-exclusive licenses to digitally distribute certain music videos and related materials owned or controlled by the three Music Labels to our OOH customers in the United States. In 2020, we entered into agreements with the Music Labels, pursuant to which we were also provided limited, non-exclusive licenses to digitally distribute certain music video recordings and related materials owned or controlled by the Music Labels in connection with our D2C business. We entered into the last of these agreements in December 2020, which ultimately allowed us to provide a more complete offering of music video content to our D2C customers beginning in 2021.

Trailers. Our film, game and TV trailer library is one of our largest video libraries. Similarly, to our music video library, it includes a back catalog of old videos, dating back to the early 1900s. More recent trailers are secured from the relevant production companies, at no cost to us, and are added to our growing library. Our back catalogue of older trailers was obtained with the acquisition of ScreenPlay.

14

Other. In addition to music videos and movie trailers, we have obtained other video content for curation and distribution to our customers. This content includes, college sports highlights, viral videos, atmospheric, travel, and kid-friendly videos.

We continue to explore opportunities to secure other forms of video content to add to our growing content library.

Content Curation

In November 2020, we created a new business division at Loop, called Loop Media Studios (“Loop Studios”), to lead the acquisition, curation, production, and branding of our video content. We believe Loop Studios was instrumental to our success in releasing more channels on OTT platforms for distribution on CTVs in 2021 than any other media company.

Loop Studios works to curate content to create a compelling user experience by, among other things, curating Playlists by genre, mood, or time periods Additionally, Loop Studios creates streaming channels, delivered under our “watch live tv” product feature on our Loop Player and Loop App. We currently have over 80 music video channels for OOH customers, 23 non-music video channels for OOH customers, and 10 music video channels for consumer end-users delivered through the Loop App on CTVs or mobile devices.

Through Loop Studios we seek to produce our own content “in-house” that can be packaged separately or as part of our third-party content offerings, and we plan to deliver this content through our existing and future channels.

Content Distribution

We aim to make our content available virtually anywhere at any time. To achieve this objective, we currently leverage our existing content across thousands of OOH locations, audio and video streaming services and mobile and connected TV apps. More specifically, there are over 5,000 active Loop Players distributed across North America and our channels are available to be viewed by millions of consumers on OTT platforms and in over 400,000 hotel rooms, serving both the OOH and D2C markets, respectively.

License Agreements

In order to stream video content to our users, we generally secure intellectual property rights to such content by obtaining licenses from, and paying royalties or other consideration to, rights holders or their agents. Below is a summary of certain provisions relating to our license agreements for music videos, the musical compositions embodied therein, as well as other non-music video content.

Music Video and A/V Recordings License Agreements with Major and Independent Record Labels

We enter into license agreements to obtain rights to stream music videos, including from the Music Labels. These agreements require us to pay royalties and make minimum guaranteed advanced payments, and they include marketing commitments, advertising inventory and financial and data reporting obligations. Rights to A/V recordings granted pursuant to these agreements is expected to account for the vast majority of our music video use for the foreseeable future. Generally, these license agreements have a short duration and are not automatically renewable. The license agreements also allow for the licensor to terminate the agreement in certain circumstances, including, for example, our failure to timely pay sums due within a certain period, our breach of material terms and certain situations involving a “change of control” of Loop. These agreements generally provide that the licensors have the right to audit us for compliance with the terms of these agreements. Further, they contain “most favored nations” provisions, which require that certain material contract terms be at least as favorable as the terms we have agreed to with any other similarly situated licensor. Our current license agreements with the Music Labels for our OOH business have been in effect (or have been renewed) for several years, and the Music Labels have requested a review and update of those licenses. Although the basic outlines of these licenses are standardized by the licensors and we do not anticipate any issue in the timely renewal of these licenses, the updating of such licenses may increase our license costs associated with such rights, including the percentage of revenue attributable to the record labels and our minimum guaranteed payment obligations. A significant majority of our OOH business relies

15

upon these licenses, and if we fail to maintain and renew these licenses our business, operating results, and financial condition could be materially harmed. With respect to our D2C business, the licenses with the Music Labels are similarly standardized, and although we do not anticipate any issue in the timely renewal of these licenses as needed. Any future updates of such licenses similarly may increase our license costs associated with such rights, including the percentage of revenue attributable to the record labels and our minimum guaranteed payment obligations. See “Risk Factors—Risks Related to Our Business—Minimum guarantees and advances required under certain of our license agreements may limit our operating flexibility and may adversely affect our business, operating results, and financial condition.”

Musical Composition License Agreements

Our business model requires that we also obtain two additional types of licenses with respect to the musical compositions: reproduction and public performance rights. Mechanical licenses are required to distribute recordings written by someone other than the person or entity conducting the distribution. Such licenses ensure that the music publisher, and ultimately the songwriter, receive compensation for use of their intellectual property. A public performance license is an agreement with the owner of a copyrighted musical composition, pursuant to which such copyright owner grants to the licensee permission to reproduce such copyrighted composition in public, online, or on radio. We have obtained direct licenses for mechanical rights with the three largest publishers, who are respective affiliates of each of the Music Labels, for our OOH and D2C businesses. As a general matter, after music licenses are obtained from the Music Labels, their affiliate publishing companies enter into agreements with respect to the mechanical licenses. If our business does not perform as expected or if the rates are modified to be higher than the proposed rates, our music video content acquisition costs could increase, which could negatively harm our business, operating results, and financial condition, hinder our ability to provide interactive features in our services, or cause one or more of our services not to be economically viable due to an increase in content acquisition costs.

In the United States, public performance rights are generally obtained through PROs, which negotiate blanket licenses with copyright users for the public performance of compositions in their repertory, collect royalties under such licenses and distribute those royalties to music publishers and songwriters. We have obtained public performance licenses from, and pay license fees to, the PROs in the United States: ASCAP, BMI, the SESAC, LLC and Global Music Rights, LLC. These agreements impose music usage reporting obligations on Loop and grant audit rights in favor of the PROs. In addition, these agreements typically have one-to-two-year terms, and some have continuous renewal provisions, with either party able to terminate for convenience within 30 to 60 days prior to the end of the applicable term (or commencement of the subsequent term), and are limited to the territory of the United States and its territories and possessions.

License Agreements with Non-Music Video Content

With respect to non-music content, we obtain distribution rights directly from rights holders. We then negotiate licenses directly with individuals or entities in return for providing such licensors with a share of revenue derived from the licensed content distributed by through our services. We are dependent on those who provide the content that appear on our services complying with the term and conditions of our license agreements. However, we cannot guarantee that rights holders or content providers will company with their obligations, and such failure to do so may materially impact our business, operating results, and financial condition.

License Agreement Extensions, Renewals, and Expansions

From time to time, our various license agreements described above expire while we negotiate their renewals. In accordance with industry custom and practice, we may enter into brief (for example, month-, week-, or even days-long) extensions of those agreements or provisional licenses and/or continue to operate on an at will basis as if the license agreement had been extended. It is also possible that such agreements will never be renewed at all, which could be material to our business, financial condition and results of operations. License agreements are generally restrictive as to how the licensed content is accessed, displayed and manipulated, as licensors seek to protect the use of their content. We may from time to time seek expansion of our licenses to provide us with greater functionality of our services as it relates to the relevant content. The inability to expand our licenses, or the lack of renewal, or termination, of one or more of our license agreements, or the renewal of a license agreement on less favorable terms, could have a material adverse effect on our

16

business, financial condition, and results of operations. If any of the above were to occur, our ability to provide any particular content that our customers favor or are seeking would be limited, which would result in those customers going elsewhere. See “Risk Factors—Risks Related to Our Business—We depend upon third-party licenses for substantially all of the content we stream and an adverse change to, loss of, or claim that we do not hold any necessary licenses may materially adversely affect our business, operating results, and financial condition.”

Competition

Our competitive market is made up of a variety of small to large companies, depending upon the area that we are competing in.

In the OOH market, we compete with several small, fragmented companies. Our direct competitors include Atmosphere, Stingray, and Rockbot. We believe that the major competitive factors in the OOH marketplace are price, technology, quality music video content and other entertainment content.

In the OTT market, we compete with a significant number of large and small companies to secure our service on OTT devices and, once on the service, we compete for individual viewers of our product. Our competitors include Vevo, Jukin Media, and Stingray. We believe that the major competitive factors in the OTT marketplace are quality content and revenue share splits.

In the consumer application market, we compete with a large number of audio-only companies for music but very few for music videos. Our direct competitors include Xcite and YouTube Music.

Marketing and Sales

Our sales and marketing efforts are primarily focused on reaching our OOH customers. Historically, our sales cycle from first contact with a potential customer to adoption of our services was relatively long and met with varying degrees of success, as the A/V equipment required to run our service was often considered expensive by many of the venues looking to acquire it. Our sales and marketing efforts historically have depended almost entirely on direct marketing by our internal sales representatives, including multiple contacts, onsite demonstrations of our services and potentially on-site installation and technical support, when needed. The introduction of our Loop Player for OOH venues has enabled us to adopt a digital marketing strategy, in addition to our direct marketing.

Following the introduction of our proprietary Loop Player, our sales and marketing strategy for OOH customers has consisted of a bottom-up and top-down approaches. Our bottom-up approach markets our Loop Player and our OOH business through digital marketing to potential business customers for use at their individual venues. The marketing reaches these businesses through the Internet, mobile devices, social media, search engines and other digital channels. Our digital marketing campaign targets businesses in certain industries that are more likely to use our services and become a customer, as determined by our past experience and by analyzing and identifying leads sourced from our online marketing channels. We are able to mail a physical Loop Player to individual businesses that sign up for our services online upon verification of the business venue. We then utilize our team of customer service personnel, digital prompts, including text messages, and promotional rewards to ensure activation of the Loop Player after receipt by the potential customer. For subscription services, a sales representative will call the potential business customer to better communicate the various subscription services pricing and availability.

Our top-down approach for OOH marketing and sales relies on our internal sales team targeting large, national or regional, franchisee or corporate-owned, businesses, to promote our Loop Player and services in multiple venues controlled by them. We often will obtain a lead for these businesses from individual venues in such business’ network of venue operators and owners. The top-down approach has a longer sales cycle, but often results in a greater reach and distribution of our Loop Player and services, since we are able to enter multiple venues at a single time, once adopted.

Our sales and marketing efforts in our D2C consumer business is more limited and relies on our internal direct marketing and sales team to approach various Smart TV and CTV operators, distributors, and manufacturers. We seek to meet their needs by providing compelling content for their networks and platforms through our Loop App or otherwise.

17

We also seek to cross-promote our OOH and D2C businesses on each respective platform and believe greater penetration of our OOH business will help drive exposure to the public consumers of our D2C products.

Seasonality

We have seen seasonality in our revenue and business related to advertising sales and the distribution of our Loop Player. This seasonality may not be reflected in our results of operations as we experienced overall growth in revenue in recent quarters and expect to continue to do so, which may obscure underlying seasonal trends. The underlying seasonality, nonetheless, may act to slow our revenue growth in any given period.

Our revenues are largely reliant on digital advertising sales. Revenue associated with such sales is dependent on our ability to fill our ad inventory for our OOH locations using our ad-supported services and the price, or CPMs, at which such inventory can be sold. Advertisers usually manage their budgets on a quarterly basis, which results in lower CPMs at the beginning of a quarter and increase at the end of a quarter. The first quarter of a calendar year (which is our second quarter) is traditionally the least profitable quarter in terms of revenue generation for ad publishers (such as us) and the fourth quarter is typically the most profitable for publishers, as companies want their brands and products to be seen in the run up to the holidays season. This generally results in publishers receiving the highest CPMs and the greatest ad demand for their ad impressions during the fourth quarter of a calendar year (our first quarter) and lower CPMs and reduced ad fill rates during the first quarter of a calendar year (our second quarter). We seek to offset the reduction in CPMs and ad fill rates with increased Loop Player distribution and ad impressions across our ad-supported services.

Our customer acquisition cost is largely influenced by the cost of our digital marketing, as a significant portion of our Loop Player distribution is reliant on OOH venues and locations responding to our on-line advertisements. We see a direct correlation between the number of digital advertisements we run and the growth in our on-line customer acquisitions. The cost of the digital ads we run fluctuates from period to period and is generally based upon the overall market CPMs and the market demand for digital ad impressions. We continuously monitor CPMs and ad demand with a view to balancing our desire to grow our distribution of Loop Players and the cost of acquisition associated with such growth. As a result, we generally look to reduce our digital marketing spend during times of peak market demand and highest cost of digital advertising and look to increase our digital marketing spend during times of lower market demand and cost. We also moderate our digital marketing spend during periods when our OOH customers may be less likely to sign up for our ad-supported OOH services (e.g., the winter holiday periods). A reduction in digital advertising spend by us during a particular period could slow our Loop Player distribution growth figures for a period of time, even as we continue to grow our overall distribution of Loop Players. We look to offset any slowed growth by, among other things, using data and analytics to make our individual digital ads more effective at acquiring customers.

Our Technology and Intellectual Property

We have developed all of our own software, computer code and related items to provide our service and do not materially rely on any third-party providers for the same. Our Loop Player is a proprietary device, designed by us and mostly built in-house. We do rely on third-party partners to provide services such as payment systems and server hosting platforms, all of which are industry-standard support systems, none of which have proprietary information and for which alternative providers can easily be found.

Our intellectual property rights are important to our business. We rely on a combination of patent, copyright, trademark, service mark, trade secret, and other rights in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our proprietary technology, processes and other intellectual property. We protect our intellectual property rights in a number of ways including entering into confidentiality and other written agreements with our employees, customers, consultants and partners in an attempt to control access to and distribution of our documentation and other proprietary technology and other information. Despite our efforts to protect our proprietary rights, third parties may, in an unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute our intellectual property rights or technology.

U.S. patent filings are intended to provide the holder with a right to exclude others from making, using, selling or importing in the United States the inventions covered by the claims of granted patents. Our patents, including our

18

pending patents, if granted, may be contested, circumvented, or invalidated. Moreover, the rights that may be granted in those issued and pending patents may not provide us with proprietary protection or competitive advantages, and we may not be able to prevent third parties from infringing those patents. Therefore, the exact benefits of our issued patents and our pending patents, if issued, and the other steps that we have taken to protect our intellectual property cannot be predicted with certainty. See “Risk Factors—Risks Related to Our Intellectual Property—Failure to protect our intellectual property could substantially harm our business, operating results, and financial condition.”

Government Regulation

Our business and our devices and platform are subject to numerous domestic and foreign laws and regulations covering a wide variety of subject matters. These include general business regulations and laws, as well as regulations and laws specific to providers of Internet-delivered streaming services and Internet-connected devices. New or modified laws and regulations in these areas may have an adverse effect on our business. The costs of compliance with these laws and regulations are high and are likely to increase in the future. We anticipate that several jurisdictions may, over time, impose greater financial and regulatory obligations on us. If we fail to comply with these laws and regulations, we may be subject to significant liabilities and other penalties. Additionally, compliance with these laws and regulations could, individually or in the aggregate, increase our cost of doing business, impact our competitive position relative to our peers, and otherwise have an adverse impact on our operating results.

Data Protection and Privacy

We are subject to various laws and regulations covering the privacy and protection of users’ data. Because we handle, collect, store, receive, transmit, transfer, and otherwise process certain information, which may include personal information, regarding our users and employees in the ordinary course of business, we are subject to federal, state and foreign laws related to the privacy and protection of such data. These laws and regulations, and their application to our business, are increasingly shifting and expanding. Compliance with these laws and regulations, such as the California Consumer Privacy Act could affect our business, and their potential impact is unknown. Any actual or perceived failure to comply with these laws and regulations may result in investigations, claims and proceedings, regulatory fines or penalties, damages for breach of contract, or orders that require us to change our business practices, including the way we process data.

We are also subject to breach notification laws in the jurisdictions in which we operate, and we may be subject to litigation and regulatory enforcement actions as a result of any data breach or other unauthorized access to or acquisition or loss of personal information. Any significant change to applicable laws, regulations, interpretations of laws or regulations, or market practices, regarding the processing of personal data, or regarding the manner in which we seek to comply with applicable laws and regulations, could require us to make modifications to our products, services, policies, procedures, notices, and business practices, including potentially material changes. Such changes could potentially have an adverse impact on our business.

Corporate History & Business Development

We were incorporated in Nevada on May 11, 2015, as Interlink Plus, Inc.

The business we operated prior to February 2020 was sold and is no longer part of our business. The following discussion of the history of the “Loop” business includes our business as operated by Predecessor Loop prior to February 2020 and as operated by us thereafter.

| ● | 2016 – Founding of Loop - Loop was founded in 2016 by Jon Niermann (our Chief Executive Officer), Liam McCallum (our Chief Product and Technical Officer), and Shawn Driscoll (our Head of Investor Relations) with the intention of developing and then delivering a streaming video music service to consumers on their mobile devices. |

| ● | 2016 - Loop Acquires 20% of ScreenPlay - In 2016, Loop acquired 20% of the outstanding shares of ScreenPlay, which operated a business-focused computer-based video service providing music video and |

19

| other content to business venues. ScreenPlay owned a vast short-form video content library that contained over 500,000 videos, including music videos and movie and TV trailers. |

| ● | 2019 - Loop Acquires Remaining 80% of ScreenPlay – In 2019, Loop acquired the remaining 80% of outstanding shares of ScreenPlay, and ScreenPlay’s content became the foundation of the Loop business. Loop acquired ScreenPlay to obtain access to and ownership of ScreenPlay’s vast video content, which could then be delivered to Loop’s target retail customers, and to benefit from ScreenPlay’s relationships with the major music label companies whose licenses would be required to provide music video content to such retail customers. We also sought to leverage our technology and innovation to gain greater access to, and expand ScreenPlay’s business with OOH venues, which relied on costly computer hardware, long lead times for customer acquisition and high monthly subscription fees. Since the acquisition of ScreenPlay, we have continued to procure additional content, through acquisitions and licenses, to further grow our video library. |

| ● | February 2020 - Loop Business Becomes Part of a Public Reporting Company — In February 2020, as a result of the Merger with Predecessor Loop, we became an early-stage media company and acquired Predecessor Loop’s video streaming business and the management team of Predecessor Loop became our management team. We subsequently changed our name to “Loop Media, Inc.” and our trading symbol for our shares quoted on the over-the-counter market operated by OTC Markets to “LPTV.” |

| ● | March 2020 - Present - COVID 19 — The spread of COVID-19 around the world beginning in early 2020 adversely affected the United States and global economies and adversely impacted our customer base with the shutdown of most OOH venues in the United States beginning in March 2020 and subsequent limitations on OOH venue capacity in many States later in 2020 and into 2021. The impact of COVID-19 pandemic has adversely impacted our revenue for 2020. We believe, however, that the COVID-19 pandemic has accelerated the consideration by OOH operators of lower cost solutions to providing visual content in their venues. |

| ● | December 2019 – October 2020 - Loop Player — We introduced the Loop Player in 2019 as a Subscription service but didn’t experience substantive growth of our OOH business until the fourth quarter of 2020 when we made the Loop Player available for free to OOH venues. Coupled with our on-line marketing campaign and the introduction of our ad-supported service model, we experienced more significant growth in our OOH business starting in late 2020 and into 2021. |

| ● | October 2020 - Spkr, Inc. — In October 2020, we acquired from Spkr, Inc., a Delaware corporation, Spkr’s website and Internet domain name, Spkr.com, a mobile application that Spkr developed, available in the Apple Inc. IOS Store as Spkr: Curated Podcast Radio, and related assets. Spkr is a free audio platform that presents highly curated and editorialized long and short-form content. We believe the Spkr platform will help us further enhance our content and provide the basis for the creation and production of our own proprietary podcast-based video content. |

November 2020 - Loop Media Studios — In November 2020, we formed, and appointed Andy Schuon as Head of, Loop Media Studios. The formation of Loop Media Studios was intended to set the foundation for strong content expansion we expect will allow our DOOH and consumer platforms scale more efficiently. Loop Media Studios is responsible for all of our content and programming creation and acquisitions for both the OOH and D2C businesses. It is charged with bringing more structure to our content, underpinned by creation, curation, editorial and execution workstreams.

| ● | December 2020 – Loop Acquires 20% of EON Media — In December 2020, we acquired from Ithaca EMG Holdco LLC, a Delaware limited liability company (“Ithaca”), approximately 20% of the issued and outstanding shares of EON Media. EON Media is headquartered in Singapore and operates at the Asian intersection of music, media, entertainment and brand marketing. EON Media’s operations include syndicated content creation, music publishing, supervision and synchronization, as well as artist agency services. EON Media is also the producer and syndicator of Asia Pop 40, Asia’s first locally produced, multi- |

20

| language weekly radio chart programs, heard every week in over 100 markets in the Asia-Pacific and the Middle East. EON Media is the first step in our expansion into Asia and we believe it will help us market our services in the region. |

| ● | April 2021 – Loop Acquires Remaining 80% of EON Media — In April 2021, we acquired the remaining outstanding shares of EON Media from Far West Entertainment HK Limited, a company incorporated in Hong Kong, and hired Robert John Graham full time, the founder of EON Media. |

| ● | May 2021 – Loop’s Advertising Revenue Model More Fully Implemented — In May 2021, we completed the first stages of integrating our advertising revenue business model into our operations to allow for greater delivery of programmatic advertising and the sale of our advertising inventory. In May 2021, we also hired Bob Gruters as Chief Revenue Officer to drive our revenue through increased sponsorship of our content, prioritizing programmatic advertising revenue. |

| ● | June 2020 -October 2021 – Leadership Team - Between June 2020 and October 2021, we added a Head of Loop Media Studios, Chief Revenue Officer, General Counsel, Chief Content & Marketing Officer, Head of Music and Controller to our leadership team and two independent members to our Board of Directors. To complement our management team and Board of Directors, we have engaged a group of experienced advisors whom we refer to as our “Advisory Board.” We believe the Advisory Board will further enhance our credibility and provide strategic guidance to our business. |

Suppliers

We source our proprietary Loop Player from a third-party manufacturer. We believe the components and raw materials required for our Loop Player are readily available from a variety of sources. We have no long-term contracts or commitments for the supply of Loop Players.

Employees

We employed approximately 49 people as of September 30, 2021, 42 of whom were full-time employees and seven of whom were hourly contract workers. None of our employees are represented by a union in collective bargaining with us. We believe that our employee relations are good.

21

ITEM 1A. RISK FACTORS.

Summary of Risk Factors

In addition to the other information contained in this report, including the matters addressed under the heading “Forward-Looking Statements,” you should carefully consider all of the risks and uncertainties described in the section of this report captioned “Item 1A. Risk Factors.” These risks include, but are not limited to, the following:

Risks Related to Our Financial Condition

| ● | We have a limited operating history on which you can evaluate our business and prospects. |

| ● | We have generated minimal revenues under our current business model, which makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance. |

| ● | We have incurred significant operating losses in the past, and we may not be able to generate sufficient revenue to be profitable, or to generate positive cash flow on a sustained basis. In addition, our revenue growth rate may decline. |

Risks Related to Our Business

| ● | If our efforts to attract prospective OOH customers and direct-to-customer users and to retain existing customers and users of our service are not successful, our growth prospects and revenue will be adversely affected. |

| ● | We depend upon third-party licenses for substantially all of the content we stream and an adverse change to, loss of, or claim that we do not hold necessary licenses may materially adversely affect our business, operating results, and financial condition. |

| ● | We face and will continue to face competition for ad-supported users, Premium subscribers, and user listening time. |

| ● | We have no control over third-party providers of our content. The concentration of control of content by our major providers means that even one entity, or a small number of entities working together, may unilaterally affect our access to music video and other content. |

| ● | We are a party to many license agreements that are complex and impose numerous obligations upon us that may make it difficult to operate our business and provide all the functionality we would like for our services, and a breach of such agreements could adversely affect our business, operating results, and financial condition. |

| ● | Our royalty payment scheme is complex, and it is difficult to estimate the amount payable under our license agreements. We may underpay or overpay royalty amounts payable to others, which may harm our business. |

| ● | Minimum guarantees and advances required under certain of our license agreements may limit our operating flexibility and may adversely affect our business, operating results, and financial condition. |

| ● | Difficulties in obtaining accurate and comprehensive information necessary to identify the compositions embodied in music video sound recordings on our service and the ownership thereof may impact our ability to perform our obligations under our licenses, affect the size of our catalog that can be offered to customers and end-users, impact our ability to control content acquisition costs, and lead to potential copyright infringement claims. |

22

| ● | Our business emphasizes rapid innovation and prioritizes long-term customer and user engagement over short-term financial condition or results of operations. That strategy may yield results that sometimes do not align with the market’s expectations. If that happens, our stock price may be negatively affected. |

| ● | If we fail to accurately predict, recommend, curate and play content that our customers and users enjoy, we may fail to retain existing customers and users and attract new customers and users in sufficient numbers to meet investor expectations for growth or to operate our business profitably. |

| ● | Expansion of our operations to deliver content beyond music videos subjects us to increased business, legal, financial, reputational, and competitive risks. |

| ● | Streaming depends on effectively working with operating systems, online platforms, hardware, networks, regulations, and standards we do not control. Changes in our service or those operating systems, hardware, networks, regulations, or standards, and our limitations on our ability to access those platforms, operating systems, hardware, or networks may seriously harm our business. |

| ● | User metrics and other estimates could be subject to inherent challenges in measurement, and real or perceived inaccuracies in those metrics may seriously harm and negatively affect our reputation and our business. |

| ● | Various regulations as well as self-regulation related to privacy and data security concerns pose the threat of lawsuits, regulatory fines and other liability, require us to expend significant resources, and may harm our business, operating results, and financial condition. |

| ● | We rely on advertising revenue to monetize our service, and any failure to convince advertisers of the benefits of advertising on our service in the future could harm our business, operating results, and financial condition. |

| ● | We depend on highly skilled key personnel to operate our business, and if we are unable to attract, retain, and motivate qualified personnel, our ability to develop and successfully grow our business could be harmed. |

Risks Related to Our Intellectual Property

| ● | Assertions by third parties of infringement or other violation by us of their intellectual property rights could harm our business, operating results, and financial condition. |

| ● | Failure to protect our intellectual property could substantially harm our business, operating results, and financial condition. |

Risks Related to Owning Our Common Stock and this Offering

| ● | The trading price of our common stock has been and will likely continue to be volatile. |

| ● | Because of their significant ownership of our common stock, our founders and other large investors have substantial control over our business, and their interests may differ from our interests or those of our other stockholders. |

| ● | Exercise of warrants, and issuance of incentive stock grants may have a dilutive effect on our stock, and negatively impact the price of our common stock. |

Our business, prospects, financial condition or results of operations could be materially adversely affected by any of the risks and uncertainties set forth below, as well as in any amendments or updates reflected in subsequent filings with the SEC. In assessing these risks, you should also refer to other information contained in this Transition Report, including our financial statements and related notes.

23

Risks Related to Our Financial Condition

We have a limited operating history on which you can evaluate our business and prospects.

We have a limited operating history on which you can evaluate our business and our prospects. Although our company has existed since 2015, we have only operated as a public early-stage media company since our Merger in February 2020. The likelihood of success of our business plan must be considered in light of the risks, substantial expenses, difficulties, complications and delays frequently encountered in connection with developing and expanding early-stage businesses and the competitive environment in which we operate.

Potential investors should carefully consider the risks and uncertainties that a company with a limited operating history will face. In particular, potential investors should consider that we cannot assure you that we will be able to, among other things:

| ● | successfully implement or execute our current business plan, and we cannot assure you that our business plan is sound; |

| ● | attract and retain experienced management and advisors; |

| ● | secure acceptance of our products and services within the industry; |

| ● | raise sufficient funds in the capital markets or otherwise to effectuate our business plan; and |

| ● | utilize the funds that we do have and/or raise in the future to efficiently execute our business strategy. |

If we cannot successfully execute any one of the foregoing, our business may not succeed and your investment will be adversely affected.

We have generated minimal revenues under our current business model, which makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

For the twelve months ended December 30, 2020, substantially all our revenues were derived from the historical business of ScreenPlay, Inc., a Washington corporation (“ScreenPlay”), which we acquired in 2019, which relies on a paid subscription service-based model in OOH locations. However, our current business plan focuses on the ad-supported service provided through our proprietary Loop Player, which we began rolling out in the fourth calendar quarter of 2020. As a consequence, our past results may not be indicative of our expected future business results. Because of the related uncertainties, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in sales, revenues, or expenses. If we make poor budgetary decisions as a result of unreliable data or if our business model is not accepted by the market, we may never become profitable and may continue to incur losses, which may result in a decline in our stock price.

24

We have incurred significant operating losses in the past, and we may not be able to generate sufficient revenue to be profitable, or to generate positive cash flow on a sustained basis. In addition, our revenue growth rate may decline.

We have incurred significant operating losses in the past and, as of September 30, 2021, had an accumulated deficit of $ (66,842,416). For the nine months ended September 30, 2021, and the twelve months ended December 31, 2020, our operating losses were $ (25,298,272) and $ (19,218,892), respectively. We have incurred significant costs to license content and continue to pay royalties or minimum guarantees to record labels, publishers, and other copyright owners for such content. We cannot guarantee that we will generate sufficient revenue from our efforts to monetize our services, including our paid subscription service and our free or unpaid advertising-supported services, to offset the cost of our content, these royalty expenses and our other operating costs. If we cannot successfully earn revenue at a rate that exceeds the operational costs, including royalty expenses and guarantee payments to the largest three music labels, associated with our service, we will not be able to achieve or sustain profitability or generate positive cash flow on a sustained basis.

Additionally, we also expect our costs to increase in future periods, which could negatively affect our future operating results and ability to achieve profitability. We expect to continue to expend substantial financial and other resources on:

| ● | securing top quality video content from leading record labels, distributors, and aggregators, as well as the publishing rights to any underlying musical compositions; |

| ● | creating new forms of original content; |

| ● | our technology infrastructure, including website architecture, development tools, scalability, availability, performance, security, and disaster recovery measures; |

| ● | research and development, including investments in our research and development team and the development of new features; |

| ● | sales and marketing, including a significant expansion of our field sales organization; |

| ● | international expansion to increase our member base, engagement, and sales; |

| ● | capital expenditures, including costs related to our technology development; and |

| ● | general administration, including legal and accounting expenses. |

These investments may not result in increased revenue or growth in our business. If we fail to continue to grow our revenue and overall business, our business, operating results, and financial condition would be harmed.

25

There is substantial doubt about our ability to continue as a going concern and if we are unable to generate significant revenue or secure additional financing, we may be unable to implement our business plan and grow our business.